Barriers to Trade (TBT) WTO

Safeguard Measures, Technical barriers to trade. Anti-dumping

- Introduction to the Technical Barriers to Trade (TBT)

- Technical regulations (labeling, terminology...)

- Conformity assessment procedures (accreditation, sampling, inspection, registration, approval)

- Agreement on Technical Barriers to Trade

The objectives of the subject “Technical Barriers to Trade (TBT)” are the following:

- To know how to identify and distinguish the Technical Barriers to Trade (TBT)

- To evaluate the possible impact that these technical barriers to the foreign trade may have on exports / imports

- To know how to act in the face of a technical barrier to trade established by a country

The Subject “Technical Barriers to Trade (TBT)” belongs to the following Online Programs taught by EENI Global Business School:

Courses: Non-tariff Measures, Foreign Trade Management.

Masters: International Business, Foreign Trade, International Transport.

Languages

Obstáculos técnicos al comercio

Obstáculos técnicos al comercio

Obstacles techniques au commerce

Obstacles techniques au commerce  Barreiras técnicas ao comércio.

Barreiras técnicas ao comércio.

Area of Knowledge: Foreign Trade. Customs.

- Non-tariff Measures in Foreign Trade (Anti-dumping Measures and safeguards, Import license and contingents)

- Trade Facilitation - Trade Facilitation Agreement - Kyoto Convention - Convention Harmonization of Frontier Controls of Goods

Technical Barriers to Trade (TBT).

The Technical Barriers to Trade (TBT) are all those Non-tariff measures that are established through the technical regulations and conformity assessment procedures (with these regulations and standards).

The Sanitary and phytosanitary (SPS Agreement) measures are not considered as a Technical Barriers to Trade.

In foreign trade, a technical regulation is a document where the product characteristics and / or their related processes and production methods are defined.

- Specifications of a technical regulation are mandatory

- Technical regulations may also contain rules on the labeling requirements, terminology, etc

To verify that the requirements of the technical regulation are met, the conformity assessment procedure is used. These procedures can be: accreditation, approval, sampling, inspection, registration...

The main Technical Barriers to Trade (TBT) are the following:

Prohibitions or restrictions of imports of products for objectives set out in the Agreement on Technical Barriers to Trade (TBT)

- Prohibitions for Technical Barriers to Trade (TBT)

- Authorization requirement for reasons of Technical Barriers to Trade

- Registration requirement for importers for reasons of technical barriers to trade

- Other requirements or prohibitions

Tolerance limits for residues and restricted use of substances:

- Residue tolerance limits or contamination by certain substances

- Restricted use of certain substances

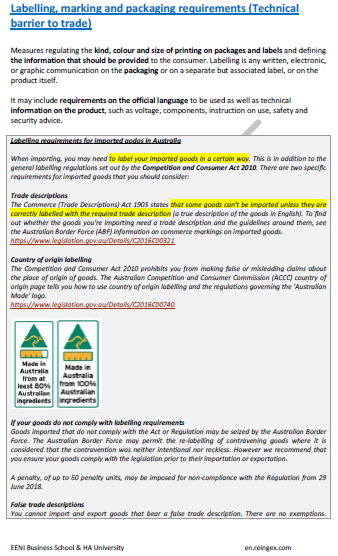

Labeling, marking and packaging requirements:

- Labeling requirements

- Marking requirements for transport

- Requirements for goods packing

Production or post-production requirements:

- Technical Barriers to Trade (TBT) regulations on production processes

- TBT regulations on transport and storage

- Other requirements

Product identity requirement (for example, organic or ecological labels).

Product-quality or performance requirement (durability, hardness, content of ingredients).

- Conformity assessment related to the Technical Barriers to Trade (TBT)

- Product registration requirement

- Testing requirement (conformity)

- Certification requirement (according to a certain standard)

- Inspection requirement (in the importing country)

- Traceability information requirements (production, processing and distribution)

Pre-shipment Inspection (quality, export price, quantity). .

- Pre-shipment inspection

- Agreement on Preshipment Inspection

- Direct consignment requirement (prohibition of stopping at a third country)

- Requirement to pass through the specified port of customs

- Import-monitoring and surveillance requirements (automatic licensing process)

- Other formalities

Contingent trade-protective measures:

- Anti-dumping measures (import at a lower value than the market of origin). Investigation, anti-dumping duties, price undertakings

- Compensatory measures (at the border, related to subsidized exports). Investigation, countervailing duties, commitments

Safeguard (countervailing) Measures:

- General safeguard (multilateral, temporary suspension of multilateral concessions to protect the national industry)

- Research, Safeguard duties. Quantitative restrictions. Other types of safeguard measures

- Special safeguard for agriculture, based on the volume or price

Prohibitions and quantity-control measures other than Sanitary and Phytosanitary Measures (SPS) or Technical Barriers to Trade (TBT) reasons:

- Non-automatic import-licensing procedures other than authorizations for SPS or TBT reasons

- Licenses for economic reasons. Licenses for specific use. Licenses linked with local production

- Licenses for non-economic reasons. Licenses for religious, moral or cultural reasons. Licenses for political reasons

- Quotas (import restrictions). Permanent / Temporary (global allocation, by countries)

- Prohibitions for reasons other than SPS or TBT measures (economic reasons or not, import prohibition, seasonal ban)

- Export limitation agreements. Voluntary limitation of exports. Agreements on quotas, consultations, administrative cooperation

- Tariff quotas: consolidated in the WTO, Countries / world allocation

Import price control measures (charges and additional taxes included. Para-tariff measures)

- Administrative measures that affect the customs value of a good (minimum and maximum prices, reference prices)

- Voluntary limitation of exports price

- Variable charges (Taxes, levies or variable components, additional customs duties)

- Customs surcharges (Taxes ad hoc imports)

- Seasonal rights (agricultural products)

- Additional taxes (related to the services provided by the State of the country of the importer): inspection fees, storage, foreign exchange transactions, consular fees..

- Internal taxes and charges on imports (with national equivalence): Consumption taxes, special charges, sensitive products

- Values set by the customs administration (avoid fraud, protect the national industry)

Sample - Technical Barriers to Trade (TBT):

Source: “International Classification of Non-tariff Measures”, UNCTAD.

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page