Agreement on Technical Barriers to Trade (TBT)

Analysis of the WTO Agreement on Technical Barriers to Trade

- Introduction to the WTO Agreement on Technical Barriers to Trade (TBT)

- Technical regulations

- Standards

- Conformity assessment procedures

- Technical Barriers to Trade- Information Management System (TBT IMS)

- Analysis of the WTO Agreement on Technical Barriers to Trade (TBT)

- Legal text of the Agreement on Technical Barriers to Trade

Sample - Agreement on Technical Barriers to Trade (TBT):

The objectives of the subject “Agreement on Technical Barriers to Trade (TBT)” are the following:

- Understand the pillars of the WTO Agreement on Technical Barriers to Trade (TBT)

- Know the concepts of the Technical regulations, Standards and Conformity assessment procedures

- An In-depth analysis of the Agreement on Technical Barriers to Trade (TBT) to evaluate the implications for an exporting company

The Subject “WTO Agreement on Technical Barriers to Trade (TBT)” belongs to the following Online Programs taught by EENI Global Business School:

Courses: Non-tariff Measures, Foreign Trade Management.

Masters: International Business, Foreign Trade, International Transport.

Learning materials in

Acuerdo sobre Obstáculos Técnicos al Comercio (OTC)

Acuerdo sobre Obstáculos Técnicos al Comercio (OTC)

Accord sur les obstacles techniques au commerce (OTC)

Accord sur les obstacles techniques au commerce (OTC)  Acordo sobre as Barreiras Técnicas ao Comércio (OTC).

Acordo sobre as Barreiras Técnicas ao Comércio (OTC).

Agreement on Technical Barriers to Trade (TBT).

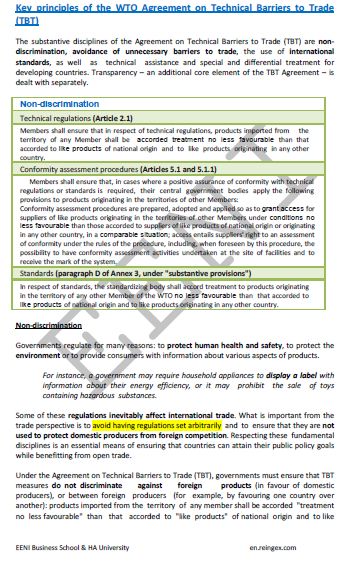

With the objective that the technical regulations (mandatory requirements), standards and conformity assessment procedures do not create Technical Barriers to Trade, nor that are discriminatory between the countries, the WTO created the Agreement on Technical Barriers to Trade (OTC).

This agreement is binding for all the member countries of the WTO.

The Agreement on Technical Barriers to Trade (TBT) belongs to the agreements on Non-tariff Measures of the WTO.

The Agreement on Technical Barriers to Trade is in force since 1995, applies to the trade in goods (not applicable to the trade in services).

The agreement does not cover issues related to the Sanitary and Phytosanitary Measures, regulated by the Agreement on the Application of Sanitary and Phytosanitary Measures. Both agreements are related.

Like other agreements of the WTO, the principles of non-discrimination, predictability in the market access or preferential treatment for the developing countries are the pillars of the Agreement on Technical Barriers to Trade (TBT).

The TBT Committee of the WTO is the body in charge of examining the special measures applied by the Governments as well as facilitating the implementation of the agreement.

Non-tariff Measures:

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page