ASEAN Free-Trade Area, Import Duties, Singapore

Tariff liberalization, ASEAN Markets. Customs. Cambodia, Laos, Myanmar, Vietnam

- Introduction to the ASEAN Free-Trade Area (AFTA)

- Free Trade Agreement of the ASEAN Free Trade Area (AFTA)

- Tariff Liberalization

- Import Duties and Tariff Rate Quotas Elimination

- ASEAN Rules of origin

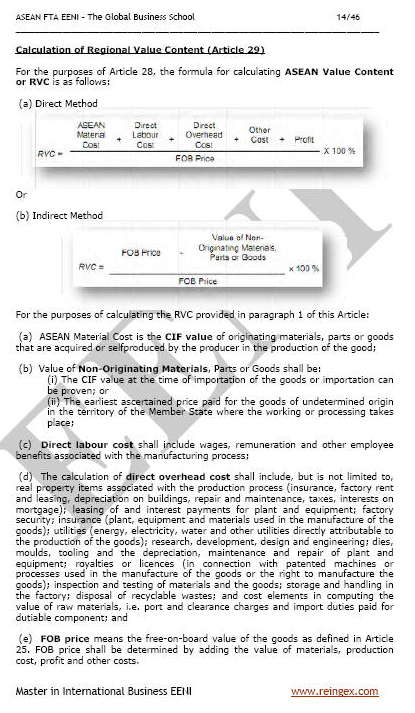

- Calculation of the Regional Value Content

- Non-tariff Measures

- Import Licensing Procedures

- Trade Facilitation

- Standards, technical regulations and conformity assessment procedures

- Sanitary and Phytosanitary Measures

- ASEAN Single Window

- ASEAN Customs;

- Customs Valuation

- Emergency situation

The Subject “ASEAN Free-Trade Area” belongs to the following Online Programs taught by EENI Global Business School:

Masters: International Business, Foreign Trade.

Languages:  or

or  ASEAN

ASEAN  Zone de libre-échange de l’ASEAN

Zone de libre-échange de l’ASEAN  ASEAN.

ASEAN.

Masters adapted to the ASEAN Students:  Brunei,

Brunei,

Cambodia,

Cambodia,

Indonesia,

Indonesia,

Laos,

Laos,

Malaysia,

Malaysia,

Myanmar,

Myanmar,

Philippines,

Philippines,

Singapore,

Singapore,

Thailand, and

Thailand, and  Vietnam.

Vietnam.

ASEAN Free-Trade Area (AFTA)

The objective of the ASEAN Free-Trade Area is to reach free trade in products in the ASEAN Region to create a single market and production base for a deeper economic integration of the ASEAN economies towards the ASEAN Economic Community achievement by 2015.

The Agreement on Common Effective Preferential Tariff Scheme for the ASEAN Free-Trade Area needs that the tariff rates levied on a huge range of foreign trade of products within the ASEAN Region be reduced to 5%.

Most of the ASEAN region is a free-trade area. Accounting for 96% of all the international trade of the Association of Southeast Asian Nations, the first six signatories of the Common Effective Preferential Tariff Scheme for the ASEAN Free-Trade Area (AFTA) have reduced their custom tariffs on the intra-regional trade to 5% for all the export products to the “Inclusion list” or removed them in total.

Sample - ASEAN Free-Trade Area (AFTA)

The member economies of the ASEAN should eliminate the import duties on all the export products traded between them by 2010 for the ASEAN-6 and by 2015, with flexibility to 2018, for CLMV (Cambodia, Laos, Myanmar and Vietnam.).

- ASEAN-6: Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand

- CLMV: Cambodia, Laos, Myanmar, and Vietnam

For ASEAN-6, by 1 January 2009 (Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand).

- Import duties of at least 80% tariff lines are eliminated

- Import duties on all the ICT products, as defined in the e-ASEAN Framework Agreement, are removed

- Import duties on all the Priority Integration Sectors products are at 0%

- Import duties on all the goods are equal to or less than 5%

For Laos, Myanmar, and Vietnam, import duties on all the products are equal to or less than 5% by 2009.

For Cambodia, import duties of at least 80% of the tariff lines are equal to or less than 5% by 2009.

- ASEAN Economic Community

- FDI in the ASEAN Countries

- ASEAN Trade Agreements: ASEAN Free-Trade Area (AFTA), Indonesia-Malaysia-Thailand Growth Triangle, Mekong Economic Cooperation Strategy, East ASEAN Growth Area, China, Canada, Australia-New Zealand, India, the EU, South Korea, Russia, the U.S., Pakistan, Japan..

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page