Techniques of the foreign trade (Online Bachelor of Science)

Techniques of the foreign trade (Bachelor of Science e-learning, third semester)

| Bachelor of Science in International Trade |

Subject - “Techniques of the Foreign Trade” (10 ECTS) - Online Bachelor of Science in International Trade (third semester).

Syllabus of the Program: International Payment Methods:

- Introduction to the different International Payment Methods

- Checks and transfers

- Clean and Documentary Collections

- Documentary credits

- Letter of Credit

- Types, modalities and variants of the Documentary Credits

- Analysis of the content of a Letter of Credit

- Documental checklist of the Documentary Credits

- Import documentary credits

- Analysis of the Documentary Credits

- UCP 600

- E-UCP

Objectives of the Program “International Payment Methods”:

- To understand the different Methods of Payment used in Foreign Trade

- To understand the importance of the documentary credit in the operations of International Trade and its functioning

- To analyze the functioning of the Documentary Credits

- To know how to manage an export or import operation with a documentary credit

Syllabus of the Program: International trade Finance

1- Export/import financing

- Introduction to export/import financing

- International risk: payment, foreign exchange, counterparty, and delivery

- Concepts of Country and Sovereign risk

- Evaluation and classification of the Country risk

- Pre-shipment finance

- Credit ratings

- Export credits (OECD)

- Other forms of export/import financing

2- Foreign Exchange Market (FOREX)

- Introduction to the Foreign Exchange Market (FOREX)

- Currency trading

- Currency exchange rates

- Methods of managing the exchange risk

- Types of coverage

- Exchange risk insurance

- Forward exchange contracts and currency options. Call/Put Options

- Spot Market and Forward Market

- Vulnerability analysis

- Players: Central banks, companies, brokers, hedge funds, investors, and speculators

- Global Financial Crisis

- Role of the Bank for International Settlements

- European Central Bank. The Euro

- Tobin tax

- Case Study: the balance of payments as a tool for credit risk analysis of a market

3- International Bonds (overseas guarantee) and Guarantees:

- Introduction to the International Bonds and Guarantees

- Advance/progress Payment Bond

- Retentions and On-Demand Bonds (“Calamity Bonds” or “Suicide Guarantees”)

- Tender and Performance Bonds

- Other types of guarantees

- Managing bonds and guarantees

- International Chamber of Commerce Rules for the Issuance of Bonds and Guarantees

- Bank obligations

- Customer liability records

- Factoring and Forfeiting

- Invoice discounting

- Endorsements

- Bills of Exchange

- Documentary Collections

- Clean Collection. Managing collections

Objectives of the Program “International Finance”:

- To understand the modalities of export/import financing

- To understand the associated risks to the foreign trade transactions

- To know how to manage the pre-financing and Export Financing

- To know the functioning of international bonds and guarantees

- To understand the fundamentals of the Foreign Exchange Market (FOREX) and the concept of exchange risk

- Know how to hedge the risk of change in exports and imports

Syllabus of the Program: Trade in Services:

- Introduction to the General Agreement on Trade in Services (AGCS)

- Agreement, Annexes, and Schedules of the GATS

- General Agreement on Trade in Services (GATS) and national regulations

- Doha Development

- Other questions related to the General Agreement on Trade in Services (GATS)

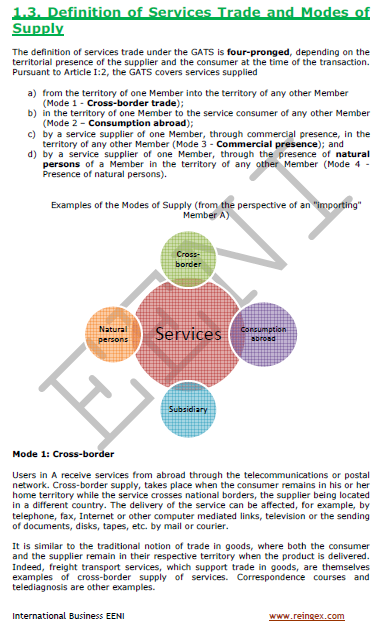

- Modes of supply of trade in services

- Transparency and liberalization in international trade in services

- Market access and national treatment

- Concept of the Most-favoured-nation

- List of commitments of the AGCS

- Case Study: Trade in Services in the U.S.-Colombia FTA and the EU-Mexico FTA

- Analysis of the World Trade in Services

Objectives of the Program “World trade in services”:

- To understand the importance of the General Agreement on Trade in Services

- To understand the key concepts related to the trade in services: modes of supply, most-favoured-nation, liberalization, market access, and lists of commitments

- To analyze the international market of services

Syllabus of the Program: Services Directive of the EU.

- Introduction to the Services Directive of the EU

- Existence of Barriers to the trade in services in the EU

- Simplification of administrative procedures for service providers

- Consumer Protection

- Implementation of the Services Directive

- Exceptions. Services of general economic interest

- European Small Claims Process

Objectives of the Program “Services Directive of the EU”:

- To understand the importance of the Services Directive of the EU in the Single Market

- To identify the Barriers to the trade in services in the EU

- To know how to take advantage of this Directive

Subjects of the third semester of the Bachelor of Science in International Trade.

ECTS: European Transfer and Accumulation System

Samples: Techniques of the foreign trade (Bachelor of Science in International Trade, e-learning, third semester).

Language of the subject “Techniques of the foreign trade” of the Bachelor of Science in International Trade (third semester):  or

or

Bachelor of Science en Comercio Internacional or

Bachelor of Science en Comercio Internacional or  Bachelor of Science en commerce international

Bachelor of Science en commerce international  Bachelor of Science em Comércio Internacionale.

Bachelor of Science em Comércio Internacionale.

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page