Inter-American Development Bank

Inter-American Investment Corporation, Development Bank. Multilateral Investment Fund

The Inter-American Development Bank (IADB) was founded in 1959 as a partnership between nineteen Hispanic America countries and the U.S..

- The Inter-American Development Bank is the largest source of multilateral financing for economic, social, and institutional development in Hispanic America and the Caribbean

- Introduction to the Inter-American Development Bank (IADB)

- Operational chart of the Inter-American Development Bank

- Member countries of the Inter-American Development Bank

- IDB Online Country Profile Tool

- Latin American and Caribbean Macroeconomic Report

- Financial and private sector markets throughout Hispanic America and the Caribbean

- Regional Economic Integration in Hispanic America (Iberian America)

- Driving growth through regional and International Trade

- Transportation and infrastructure projects

- Integration of Regional Infrastructure in South America (IIRSA)

- Case Study: Integration and development hubs in Hispanic America

- Inter-American Investment Corporation

- Multilateral Investment Fund

- IDB Projects

- Policies for the Procurement of Goods and Works financed by the Inter-American Development Bank

- Project Cycle of the Inter-American Development Bank: preparation, approval, implementation, completion, and evaluation

Sample - Inter-American Development Bank:

The educational aims of the Subject “Inter-American Development Bank (IDB)” are:

- To understand the goals, structure, and functions of the Inter-American Development Bank

- To learn about Initiative for Integration of Regional Infrastructure in South America, the Multilateral Investment Fund, and the Inter-American Investment Corporation

- To explore the funds and the financial instruments of the Inter-American Development Bank

- To understand the projects and operations of the Inter-American Development Bank

- To learn about the Latin American and Caribbean Macroeconomic situation

The Subject “Inter-American Development Bank (IADB)” is included within the curriculum of the following academic programs at EENI Global Business School:

Masters: International Business, Foreign Trade.

Languages:  or

or

Banco Interamericano Desarrollo

Banco Interamericano Desarrollo  Banco Interamericano Desenvolvimento

Banco Interamericano Desenvolvimento  Banque Interamericaine.

Banque Interamericaine.

- Subject Credits “Inter-American Development Bank”: 2

- The Inter-American Development Bank is owned by forty-eight member economies, of which twenty-six are borrowing members in Hispanic America and the Caribbean

- Each member of the Inter-American Development Bank has his voting power, based on its subscription to the institution's ordinary capital resources

- The Group of the Inter-American Development Bank consists of the Inter-American Development Bank (IDB), the Inter-American Investment Corporation and the Multilateral Investment Fund

The Inter-American Investment Corporation is a multilateral investment institution that is part of the Inter-American Development Bank Group.

- Its mandate is the economic development promotion of its Hispanic America and the Caribbean member countries by financing private enterprise, preferably small and medium in scale

Multilateral Investment Fund.

- The Hispanic America microcredit portfolio grew by 35% a year, with the number of customers increasing by 25% annually

Borrowing member countries:

- The Inter-American Development Bank has twenty-six borrowing member countries, all of them in Hispanic America and the Caribbean

- Together; they have a 50.02% of the voting power on the Inter-American Development Bank board

Groups I and II

In 1999, the Inter-American Development Bank started using a nation grouping. This criterion divides countries into Groups I and II, based on their gross national product per capita.

- On the basis of their lower per capita revenue, the Inter-American Development Bank channels 35% of its lending volume to the Group II countries: Belize, Bolivia, Colombia, Costa Rica, the Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Nicaragua, Panama, Paraguay, Peru, and Suriname

- 65% of the lending volume is thus channeled to the Group I countries: Argentina, the Bahamas, Barbados, Brazil, Chile, Mexico, Trinidad and Tobago, Uruguay, and Venezuela

Furthermore, to these two groups, the Inter-American Development Bank has the mandate to devote at least 50% of its operations and 40% of its resources to programs that promote the social equity and poverty reduction.

The Inter-American Development Bank non-borrowing members include the United States, Canada, Japan, Israel, Korea, and sixteen European Countries: Austria, Belgium, Croatia, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Portugal, Slovenia, Spain, Sweden, Switzerland, and the UK.

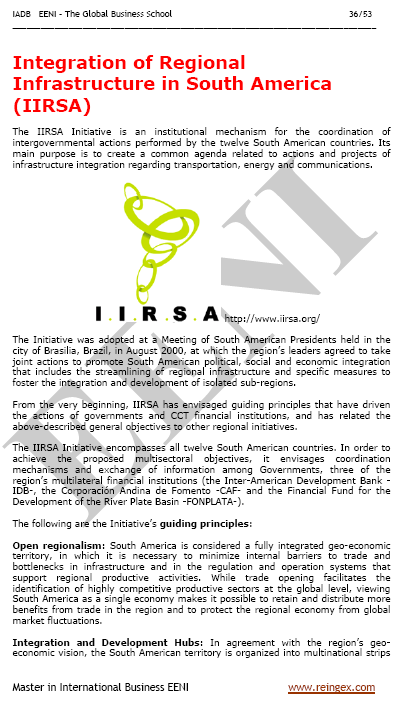

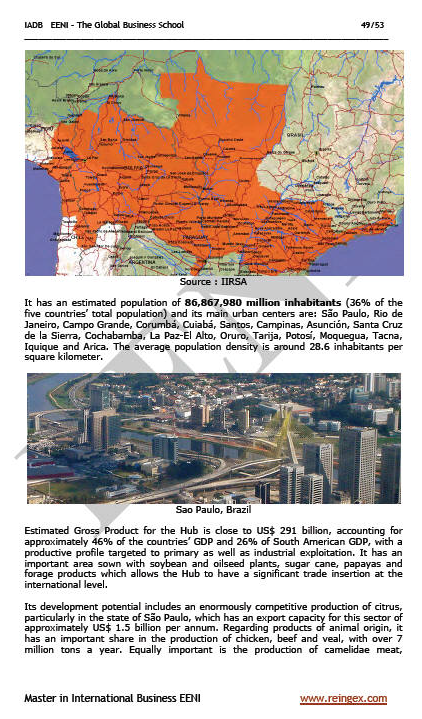

The Integration of Regional Infrastructure in South America is an institutional mechanism for intergovernmental coordination actions performed by the twelve South American Countries. Its main goal is to create a common agenda related to actions and infrastructure integration projects regarding the Logistics, energy, and communications.

The integration and development hubs are multinational territories involving natural spaces, human settlements, production areas, and actual International Trade flow. Infrastructure investments will create new opportunities for sustainable development for the population of these territories.

Integration and development hubs in Hispanic America: Andean, Southern Andean, Capricorn, Paraguay-Parana Waterway, Amazon, Guianese Shield, Southern, Central Inter-oceanic, MERCOSUR-Chile, and Peru-Brazil-Bolivia.

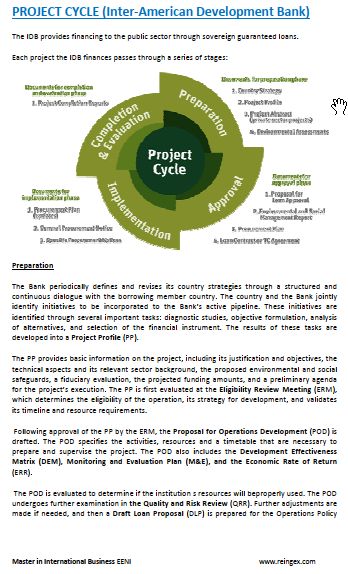

The Inter-American Development Bank Project Cycle.

Each project the Inter-American Development Bank finances passes through a series of stages; principally preparation, approval, implementation, and termination and evaluation, known as the Project Cycle.

(c) EENI Global Business School (1995-2025)

Top of this page

WhatsApp

WhatsApp