World Customs Organization (WCO) Harmonized System

Custom valuation. Rules of origin. Trade facilitation. SAFE Package

- Introduction to the World Customs Organization (WCO)

- The Harmonized System (HS) of the WCO

- Customs Valuation

- Rules of Origin

- Agreement on Rules of Origin of the WTO

- Customs Enforcement and Compliance

- SAFE Package

- Customs Procedures and Trade Facilitation

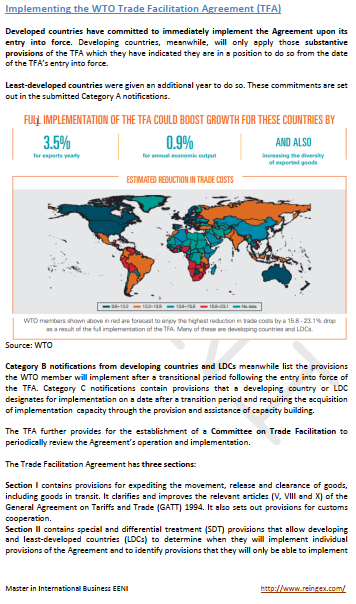

- Trade Facilitation Agreement

- Mercator program

- Conventions:

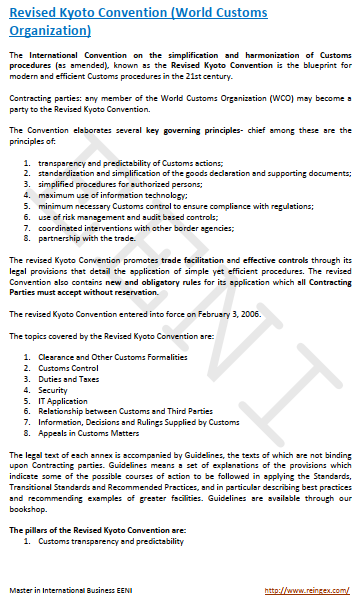

- Kyoto Convention

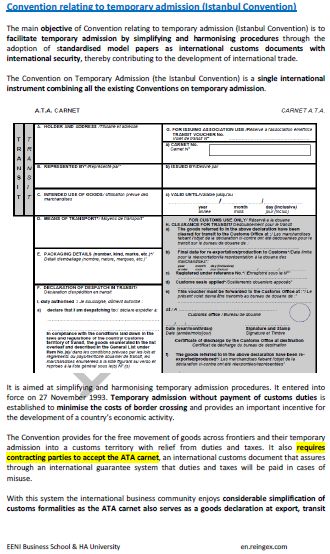

- ATA System

- Istanbul Convention

- Customs Convention on Containers

- Case Study: market access map

The purposes of the subject “World Customs Organization (WCO)” are the following:

- To know the role of the WCO

- To understand the key concepts related to the customs: non-tariff barriers, customs valuation, transaction value, previous inspection, rules of origin, and import licenses

- To know the Harmonized System and the existing conventions

The Subject “World Customs Organization (WCO)” belongs to the following Online Programs taught by EENI Global Business School:

Courses: Export Assistant, Foreign Trade Management.

Masters: International Business, Foreign Trade, International Transport.

Doctorate: Global Logistics, World Trade.

Languages:  or

or  Organization mondiale des douanes

Organization mondiale des douanes  Organización Mundial de Aduanas

Organización Mundial de Aduanas  Organização Mundial das Alfândegas (OMA).

Organização Mundial das Alfândegas (OMA).

The members of the WCO represent 98% of global trade.

World Customs Organization

The World Customs Organization (WCO) is the sole intergovernmental body fully working on customs and international trade (imports and exports).

The World Customs Organization (WCO) keeps the International Harmonized System products nomenclature and manages the technical aspects of the WTO Agreements on Customs Valuation and Rules of Origin.

The World Customs Organization works in the following fields:

- International Trade standards development

- Simplification and harmonization of the Customs Procedures (imports and exports)

- International Trade supply chain security

- International trade facilitation

- Customs enhancement and accordance activities, anti-counterfeiting and piracy initiatives

The World Customs Organization (WCO) has developed the Harmonized Commodity Description and Coding System (Harmonized System - “HS”), an international product nomenclature. 98% of the international trade in goods use the Harmonized System.

The BIC Code (International Identification Codes of Container Owners) is accepted by the World Customs Organization (WCO):

The World Customs Organization (WCO) member countries are:

The European Union, The customs territories of Netherlands Antilles, Bermuda, Hong Kong and Macau, Albania, Algeria, Andorra, Angola, Argentina, Armenia, Australia, Austria, Azerbaijan, the Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Benin, Bhutan, Bolivia, Botswana, Brazil, Brunei, Bulgaria, Burkina Faso, Burundi, Cambodia, Cameroon, Canada, Cape Verde, Central African Republic, Chile, People's Republic of China, Colombia, The Comoros, the Republic of the Congo, Costa Rica, Ivory Coast, Croatia, Cuba, Cyprus, The Czech Republic, DR Congo, Denmark, Ecuador, Egypt, El Salvador, Eritrea, Estonia, Ethiopia, Fiji, Finland, Republic of Macedonia, France, Gabon, The Gambia, Georgia, Germany, Ghana, Greece, Guatemala, Guinea, Guyana, Haiti, Honduras, Hungary, Iceland, India, Indonesia, Iran, Iraq, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, Kenya, South Korea, Kuwait, the Kyrgyz Republic, Latvia, Lebanon, Lesotho, Liberia, Libya, Lithuania, Luxembourg, Madagascar, Malawi, Malaysia, Maldives, Mali, Malta, Mauritania, Mauritius, Mexico, Moldova, Mongolia, Morocco, Mozambique, Myanmar, Namibia, Nepal, Netherlands, New Zealand, Nicaragua, Niger, Nigeria, Norway, Oman, Pakistan, Panama, Papua New Guinea, Paraguay, Peru, The Philippines, Poland, Portugal, Qatar, Romania, Russia, Rwanda, Samoa, São Tomé, Saudi Arabia, Senegal, Serbia, the Seychelles, Sierra Leone, Singapore, Slovakia, Slovenia, South Africa, Spain, Sri Lanka, Sudan, Suriname, Eswatini, Sweden, Switzerland, Syria, Tajikistan, Tanzania, Thailand, East Timor, Togo, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Uganda, Ukraine, the Emirates, the UK, the U.S., Uruguay, Uzbekistan, Venezuela, Vietnam, Yemen, Zambia, Zimbabwe.

No members Countries of the WCO: Antigua and Barbuda, Saint Kitts and Nevis, Saint Vincent and the Grenadines, Grenada, Dominica, Equatorial Guinea, Somalia, North Korea, Liechtenstein, Monaco, San Marino, Vatican City, Palau, Solomon Islands, Micronesia, Kiribati, Marshall Islands, Tuvalu, Nauru, Cook Islands, Niue and Palestinian Authority, Taiwan, Sahrawi Republic, Kosovo.

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page