Arab Trade Financing Programme (ATFP) Emirates

Arab Free Trade Zone. Financing, Islamic Sharia. United Arab Emirates

- Introduction to the Arab Trade Financing Programme (UAE)

- Intra-Arab Trade Promotion

- Support for the Arab Free Trade Zone

- Financing tools in accordance with the Islamic Sharia

The Subject “Arab Trade Financing Programme (ATFP)” belongs to the following Online Programs taught by EENI Global Business School:

Masters: International Business, Foreign Trade.

Doctorate: Islamic Business, African Business, World Trade, Ethics, Religion & Business.

Languages:  (

( Financement Commerce Arabe

Financement Commerce Arabe  Financiación comercio árabe

Financiación comercio árabe  Organization of Islamic Cooperation).

Organization of Islamic Cooperation).

Arab Trade Financing Programme.

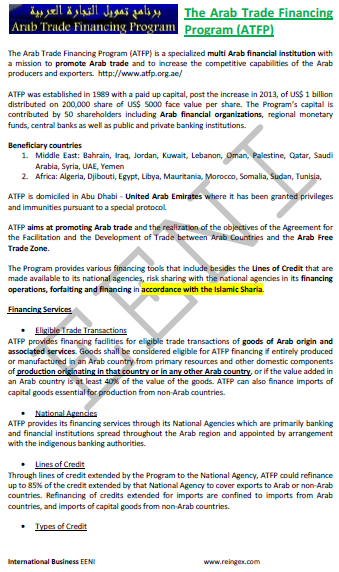

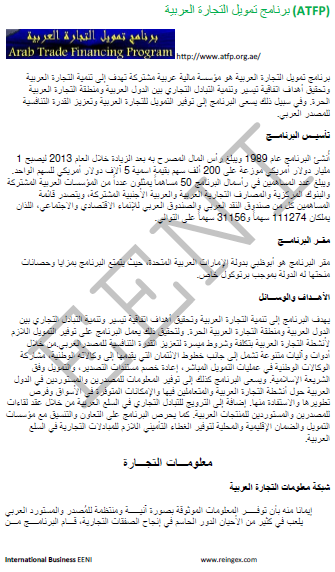

Financial institution (Arab Development Funds): Arab Trade Financing Programme (ATFP).

- Created in 1989 in Abu Dhabi (Emirates)

- The main objective is to promote the intra-Arab trade

- Support to the Arab Free Trade Zone

- The Arab Trade Financing Programme is the promoter of the Intra-Arab Trade Information Network (IATIN)

- Financing tools in accordance with the Islamic Sharia: financing, forfeiting, lines of credit

- The eligible products and services should be considered as “Arab origin” (entirely manufactured in an Arab nation, or 40% of the local added value)

- Import finance of capital goods

- Pre-export and import credits

- Post-shipment credits

- The Arab Trade Financing Programme (ATFP) is a Muslim fund of the Islamic Civilization

Sample - Arab Trade Financing Programme (ATFP)

The Beneficiary countries of the Arab Trade Financing Programme are:

- Africa: Algeria, Djibouti, Egypt, Libya, Morocco, Mauritania, Sudan, Somalia and Tunisia

- Middle East: Bahrain, Iraq, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, the Emirates, and Yemen

Related information

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page