New Union Customs Code (European Union)

Novelties of the New Union Customs Code (European Union). Special Regimes

- Introduction to the New Customs Code of the EU

- Main novelties of the New Union Customs Code

- Analysis of the New EU Customs Code

- The EU product classification system

- Tariff Nomenclature

- Customs Debt and Guarantees

- Goods Receipt, Declarations and Simplifications

- Customs Status, Transit and leaving the EU Customs Territory

- Special Regimes

- Authorized Economic Operators

- Exporter Registration System

- Analysis of the New Union Customs Code

Sample - New Union Customs Code:

The objectives of the subject “New Union Customs Code” are the following:

- To understand the New Union Customs Code

- To analyze the new simplified customs procedures of the EU

- To know the EU special regimes

The Subject “European Union Customs Code” belongs to the following Online Programs taught by EENI Global Business School:

Masters: International Business, Foreign Trade.

Languages:  or

or  Código Aduanero UE

Código Aduanero UE  Code des douanes de l’UE

Code des douanes de l’UE  Código Aduaneiro da UE.

Código Aduaneiro da UE.

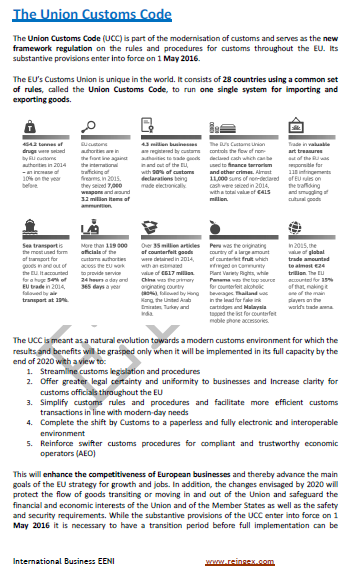

The new Customs Code of the EU and its complementary rules have been in force since 1 May 2016. The fundamental objective is to consolidate the European economic integration by optimizing the customs procedures of the EU (Customs Union) as well as enhancing foreign trade.

The complementary rules of the new European Customs Code define the European customs procedures.

The new European Customs Code enhances the use of new information technologies and the role of the economic operators. The concept of customs value and exporter has been redefined.

The Customs regimes are referred to as special regimes and can be:

A) General.

- Release for free circulation

- export

B) Specials:

- Storage (customs warehouse and free zones)

- Transit (external or internal)

- Special destination (temporary importation and final destination)

- Improvement (passive and active)

In the New Customs Code, free warehouses, free zones (type II) or reimbursement system for the inward processing are eliminated.

A new exporter registration system is defined for the beneficiary countries of the GSP.

This new code replaces the previous one.

The Union Customs Code belongs to the European Economic Area (Western Civilization).

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page

EU Students

EU Students