How to export to the European Union

Procedures for importing from the European Union / export to the EU

- Import procedures of the EU

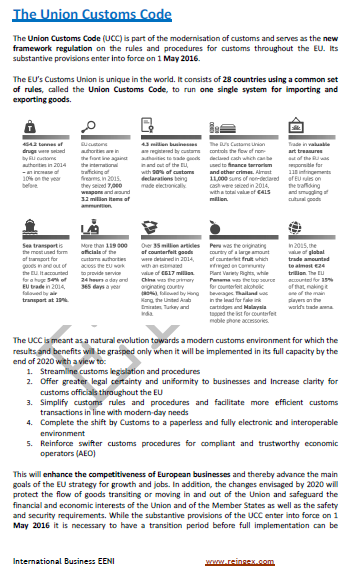

- New Union Customs Code

- The EU Help System: Export Helpdesk

- Economic operator registration and identification number (EORI)

- Entry summary declaration

- Customs destination

- Customs warehouses

- Single Administrative Document (DUA)

- Customs value

- Sanitary and phytosanitary requirements

- Environmental requirements

- Technical requirements. CE Marking of European Conformity

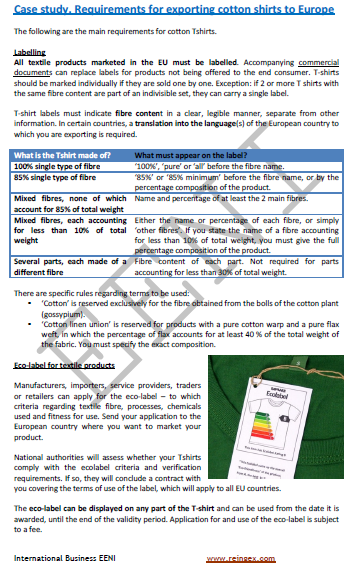

- Case Study. Requirements for exporting coffee, cotton t-shirts and rum to the EU

- Excise duties on imports into the EU

- Marketing standards

- Tariffs in the EU. EU Binding Tariff Information System (BTI)

- Import restrictions. Contingents and Quotas

- Anti-dumping

- Value Added Tax in the EU

- TARIC database (tariffs and rules on import products into the EU)

How to export to the EU:

The objectives of the subject “How to export to the EU” are the following:

- To learn the necessary procedures to export a good to the EU or import from the EU

- To know the requirements and standards needed to import

- To understand how to identify the import restrictions and quotas

- To analyze the applicable tariffs

The Subject “How to export to the European Union” belongs to the following Online Programs taught by EENI Global Business School:

Doctorate: World Trade.

Masters: International Business, Foreign Trade.

Languages:  or

or  Exportar a la UE

Exportar a la UE  Exporter vers l’UE

Exporter vers l’UE  Exportar para a UE.

Exportar para a UE.

The New EU Customs Code contains all the rules, requirements and procedures for importing goods into the EU or exporting to the EU from the third countries.

All the EU countries apply this customs code: Austria, Belgium, Bulgaria, Croatia, Cyprus, Denmark, France, Estonia, Finland, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, the Czech Republic, Romania and Sweden.

Both companies and individuals must have the economic operators' registration and identification number (EORI). An exporter who is not a member of the EU must apply.

When a product from a third country enters into the customs territory of the EU, the entry summary declaration must be lodged.

When a good entry into the EU Customs territory they do so in the form of a temporary deposit (maximum of 90 days) until is assigned to a customs destination:

- Release for free circulation

- Special Procedures;

- Transit (internal or external)

- Deposit

- Special destination (Temporary admission, Final destination, Inward processing / passive traffic)

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page

EU Students

EU Students