Intra-African Trade. Export Diversification

Action Plan for Boosting Intra-African Trade, cross-border

The Subject “Intra-African Trade” consists of two parts:

1- Introduction to the Intra-African Trade.

- Obstacles to the Intra-African Trade

- African exports diversification

- Lack of African infrastructures

- Free-Trade Areas in Africa

- Trade liberalization

- Technical Barriers to Trade

- Cross-border African trade

- African customs

- Information networks

- Information and communications technology (ICT)

- High costs of doing business in Africa

- The African financial markets and the access to credit

- Currencies: Multiplicity and non-convertible.

- The case of the CFA Franc and the South African Rand

- Free movement of people, labour, and capital

- Lack of African regional frameworks for services in trade liberalization

2- Action Plan for Boosting Intra-African Trade (Economic Commission for Africa / African Union).

- Trade Policy

- Trade Facilitation

- Trade-Related Infrastructure

- Trade Finance

- Trade Information

- Factor Market Integration

- Towards the African Continental Free-Trade Area (AfCFTA)

The Subject “Intra-African Trade” belongs to the following Online Programs taught by EENI Global Business School:

Doctorate in African Business, World Trade.

Course: Regional Integration in Africa.

Master in Business in Africa, Transport in Africa, International Business, Foreign Trade, International Transport.

Languages:  or

or  Commerce Intra-Africain

Commerce Intra-Africain  Comercio intra-africano

Comercio intra-africano  Comércio intra-africano.

Comércio intra-africano.

Action Plan for Boosting Intra-African Trade.

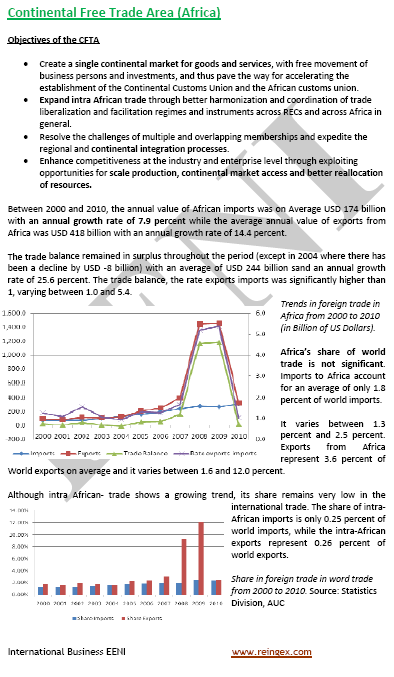

The main objective of the Action Plan for Boosting Intra-African Trade is to reach 25% of the intra-African trade (currently, is 10% - 13%) through the regional integration.

The final aim is to create a continental market (African Common Market): the African Continental Free-Trade Area (AfCFTA).

Although the African products have a competitive cost “in factory (EXW)” but the distribution process in Africa (transport, handling, customs, and storage) increases the final price and therefore generate a loss of competitiveness.

The Action Plan for Boosting Intra-African Trade identifies several obstacles to the Intra-African Trade (Export Diversification, Lack of infrastructures, African trade barriers, African cross-border trade, customs).

One of the troubles of the intra-African trade is the long delay of Customs in Africa (12 days), to high compared by example with Central Asia (6 days).

Near 80% of the African exports are exported out of Africa.

The development of National Single Windows is a key factor to improve the intra-African trade.

Regional Economic Communities (REC), like Common Market for Eastern and Southern Africa (COMESA), EAC (East African Community), Southern African Development Community (SADC), IGAD (Intergovernmental Authority on Development), Economic Community of West African States (ECOWAS), Community of Sahel-Saharan States (CEN-SAD), ECCAS (Economic Community of Central African States) or the Arab Maghreb Union are the key pillar of this vision according to the Treaty of Abuja (the African Economic Community).

The Regional Economic Communities are working in free-trade areas, customs union, common markets and economic and monetary unions.

The Economic Commission for Africa and the African Union are the promoters of this ambitious plan.

The COMESA-EAC-SADC Agreement or the OHADA are good examples of the regional integration in Africa that can boost the intra-African trade.

Today, Africa only represent 3% of the global trade. China, India, the EU, and the U.S. (African Growth and Opportunity Act (AGOA) programme) are the top partners of Africa.

Sample - Intra-African Trade

Sample:

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page