Sharia: Islamic Law of the Quran, Moral code

Set of rules which govern the entire existence of Muslim (Sharia): ethical and moral code

Sharia law prohibits interest (riba), which has given rise to a $4 trillion Islamic finance industry (Reuters, 2025). Banks such as HSBC offer sukuk (Islamic bonds) and murabaha (cost-plus financing), with annual growth of 12%. This system influences investment in 57 Muslim-majority countries.

Religions and Global Business -

Religious diversity

In principle, in all those countries where Sharia is applied, total or partially, shall apply only to Muslims; other religions should have a different law.

For business, Sharia should not affect an exporter directly in Foreign Trade operations. However, Sharia can affect Pricing policy, product, or promotion. It may also affect when opening a branch or hiring local Muslim workers.

- Introduction to Sharia (Islamic Law)

- The Holy Quran and Sunnah as sources of Sharia

- Sharia as Ethical and Moral code

- Implications of Application of Sharia on Islamic societies

- Sharia and Business

- Application of Sharia by country

Sample - Sharia - Islamic Law (Islamic Civilization)

The Subject “Sharia: Islamic Law” is included within the curriculum of the following academic programs at EENI Global Business School:

Masters: Religions & Business, Business in Africa, International Business

Doctorate: Ethics, Religion & Business.

Languages:  or

or  Sharia

Sharia  Sharia

Sharia  Sharia.

Sharia.

The Five pillars of Islam - Fiqh (Islamic Jurisprudence) - Human Rights in Islam.

Sharia (“what is prescribed”), is a set of rules that govern the entire existence of a Muslim.

- Sharia is an ethical and moral code and a set of laws

- Quran is the first and main legal source of Islam

- violation of the Islamic Law is an offence against God

- Unlike Western Civilization, Islam believes that its laws are of divine origin, and they were revealed by Allah to the Prophet to establish the ideal social order on earth

Therefore, for a Muslim, it may be tough to accept the Western concept of separation between State and Church. It is crucial to understand this point.

The two main sources of Sharia are:

- Holy Quran: The source of Sharia

- Sunnah: The second source of Sharia.

- Sunnah contains religious actions and quotations of the Prophet Muhammad narrated by his fellows (Sunni branch) and Imams (Shi'a branch)

- Much of Sunnah is recorded in the Hadith

According to Sunni School of law, the secondary sources of Islamic law are Ijma or consensus of the Islamic Community (Ummah) and Itihad (an individual effort to reflect).

Sharia, or Islamic Law, covers a broad range of topics (Economics, Banking, law, health, or family relationships), its implementation depends on each country.

Traditionally “Sharia Courts” are not dependent on lawyers since plaintiff, defendant has represented themselves.

- Trials are conducted only by the judge; there is no jury system

- Non-Muslim minorities are eligible to Sharia courts if they wish

- There is neither process before trial nor any questioning witnesses

- The verdicts of the judges do not establish binding precedents

- Instead of written evidence, the oath has much more importance, instead of being used simply to guarantee truth of testimony, are used as evidence

- Having the testimony of a witness is more importance than a written proof; it is evident that a contract has much less importance than a verbal agreement. This is an issue that we should never forget when doing business in countries that wholly or partially implemented Sharia Law

In the history of Islam, Sharia has always coexisted with other legal systems. Today, few Muslim Countries apply strictly and comprehensively the whole code of Sharia; many only apply some aspects of Sharia.

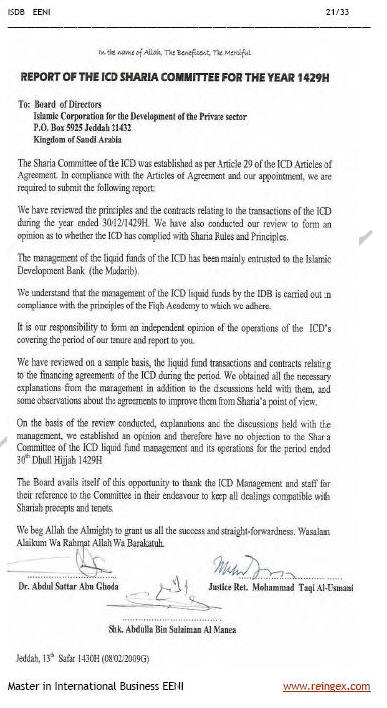

Sulaiman Al-Rajhi created the Al-Rajhi Bank one of the largest Islamic banks, offering products and services according to Sharia principles.

The International Bank of Kuwait (Bukhamseen Group) is an excellent example of Sharia Supervisory Board.

Arab Trade Financing Programme (ATFP).

An example of Sharia Report of the Islamic Development Bank.

(c) EENI Global Business School (1995-2025)

Top of this page

WhatsApp

WhatsApp