Exchange Market (FOREX)

Foreign Exchange Market (FOREX). Currency Trading. Options

- Introduction to the Foreign Exchange Market (FOREX)

- Global Financial Crisis

- Role of the Bank for International Settlements

- European Central Bank. Euro

- Tobin tax

- Currency trading

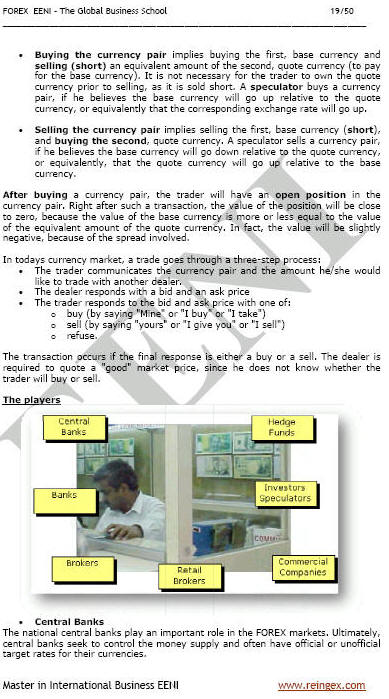

- Players: Central banks, companies, brokers, hedge funds, investors, and speculators

- Currency exchange rates

- Methods of

managing the exchange risk

- Types of coverage

- Exchange risk insurance

- Forward exchange contracts and currency options. Call/Put Options

- Spot Market and Forward Market

- Vulnerability analysis

- Case Study: the balance of payments as a tool for the credit risk analysis of a market

The objectives of the subject “Foreign Exchange Market (FOREX)” are the following:

- To analyze the fundamentals of the Foreign Exchange Markets, understand their functioning and examine the agents operating in these markets

- To know the various methods of managing the exchange risk

- To examine in detail the forward exchange contracts and the currency options

Foreign Exchange Market (FOREX)

The Subject “Foreign Exchange Market (FOREX)” belongs to the following Online Programs taught by EENI Global Business School:

Course: International Payment methods.

Masters: International Business, Foreign Trade and Marketing.

Languages:  or

or  Financement

Financement

Financiación

Financiación  Financiamento.

Financiamento.

Foreign Exchange Market (FOREX).

The Foreign Exchange (FOREX) market is by far the largest market in the World.

The 1.5 trillion dollars average daily turnover dwarfs the daily turnover in all the World's stock and bond markets combined.

The New York Stock Exchange has a daily trading volume of approximately USD 30 billion. One trillion dollars (USD 1,000,000,000,000) changes of hands every day in the global Foreign Exchange Markets.

80% of this trading is speculative, buying and selling money for profit's sake.

Investing in foreign exchange remains mainly a domain for the big professional players in the market such as the hedge funds, banks, and brokers.

The currency exchange market is a true 24-hour market, five days a week. There are dealers in every major time zone.

The largest dealing centers are London (50% of the market), followed by New York

- The first session, which is the Asian session, begins on Sunday evening at approximately 7:00 p.m. EST (Sydney)

- The second session, which is the London session, starts at approximately 2:00 a.m. EST

- The third and final session, which is the New York session, begins at approximately 7:00 a.m. EST and ends at 5:00 p.m. EST

The Bank for International Settlements (BIS) is an international organization which foster the international monetary and financial cooperation and serves as a Bank for the central banks.

The currency exchange market determines the currency exchange rates. A currency exchange rate is always quoted for a currency pair using the ISO code abbreviations.