International Bonds, Guarantees, Documentary Collections

Factoring, Forfeiting, Bonds, Guarantees, Clean collection. Bills of Exchange

- Introduction to the International Bonds (overseas guarantee) and Guarantees

- Tender and Performance Bonds

- Advance/progress Payment Bond

- Retentions and On-Demand Bonds (“Calamity Bonds” or “Suicide Guarantees”)

- Other types of guarantees

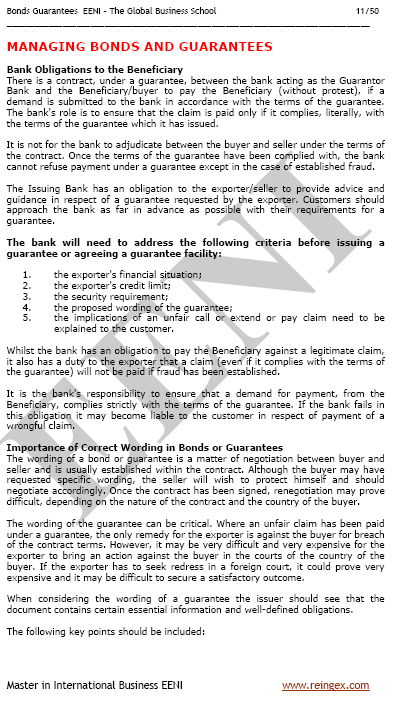

- Managing bonds and guarantees

- Bank obligations

- Customer liability records

- The International Chamber of Commerce Rules for the Issuance of Bonds and Guarantees

- Factoring and Forfeiting

- Reverse factoring (Confirming)

- Invoice discounting

- Endorsements

- Bills of Exchange

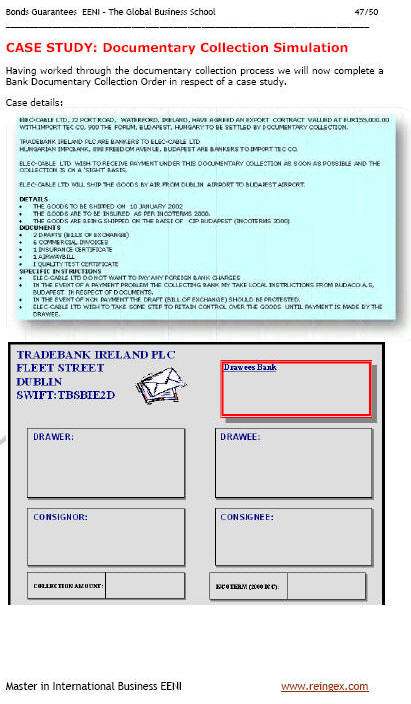

- Documentary Collections

- Clean Collection. Managing collections

Factoring and Forfeiting

In this part, we will explore the export finance products that are growing rapidly. We will explore Factoring, Invoice Discounting, and work through the procedure for a Forfeiting transaction.

In this part, the student will:

- Become familiar with the fundamentals of Factoring

- Learn what benefits the factoring offers to a growing business

- Study the fundamentals of Forfeiting

- Discuss the differences and similarities between Factoring and Forfeiting

- What Invoice Discounting is and how it compares to the Factoring

Objective: to gain a good understanding of Forfeiting, Factoring, and Invoice Discounting.

Documentary collections

The objective of this part is to understand what Documentary collections are and how they work. Export and import Collections will be analyzed.

In this part, the student will:

- Learn that Documentary collections are a service provided by the Bank whereby the Bank facilitates the settlement of the payment between the importers and exporters by a collection of financial and commercial documents

- Discover that the Collections offer a greater degree of security to the exporter than open account transactions

- Understand the operation of:

- Export Collections

- Import Collections

The main objective of the Subject “International Bonds and Guarantees” is to learn about the different types of bonds and guarantees and how they operate. In this Subject, the student will:

- Learn what types of bonds and guarantees there are and how they operate

- Analyze the advantages and disadvantages of the different types of bonds/guarantees for the exporters

- Discuss the involved parties and their responsibilities

- Examine how the banks manage bonds/guarantees

- Gain a good understanding of Forfeiting, Factoring, and Invoice Discounting

The Subject “International Bonds and Guarantees” belongs to the following Online Programs taught by EENI Global Business School:

Masters: International Business, Foreign Trade and Marketing.

Languages:  or

or  Financement

Financement

Financiación

Financiación  Financiamento.

Financiamento.

International Bonds and Guarantees.

An overseas guarantee or bond is a written undertaking by a Bank to a foreign party that the Bank will pay a sum of money against a written demand for payment or submission of a document (or documents) stipulated in the guarantee document itself, upon the occurrence of a specified event or events.

The words “guarantee” and “bond” are interchangeable, and no particular relevance is attached to the use of either of these terms.

The importer requests a tender bond when the tenders or quotations are invited from sellers/exporters for a product purchase or manufacture or for a project management.

The outcome of a successful tender is the award of a contract and some cases, the eventual submission of a performance bond or guarantee.

The conditions of a performance bond or guarantee are sometimes stipulated in a letter of credit opened by an importer in favor for the exporter. In such cases, the letter of credit (LC) does not become operative until the performance guarantee is established in favor to the importer.

An on-demand bond (“Calamity Bonds” or “Suicide Guarantees”) is where the Bank is providing the bond has an obligation to pay upon first demand, if such demand is made literally by the terms of the bond. Many importers (particularly in the middle east) will only accept this type of on-demand bond or “demand guarantee.”

The International Chamber of Commerce first published the Uniform Rules for Contract Guarantees (ICC Publication No. 325) in 1978. The rules are intended to regulate the guarantees and cover tender bonds, performance guarantees and repayment guarantees given by banks, insurance companies and other guarantors.

Unlike the UCP 600 for Documentary Credits, the Guarantee Rules of the International Chamber of Commerce are not broadly used in Central Asia or other parts of the World.

Collections are a service provided by banks to their export and import customers with the objective of payment collection under the structure and security of an internationally accepted body of rules known as URC 522 of the International Chamber of Commerce, Paris, France.

Using the collections, the banks facilitate the settlement of payment between the importers and exporters. Collections offer a greater degree of security to the exporter than open account transactions.

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page