Foreign Trade of Brazil. Brazilian Exports

Brazil in the global economy. Brazilian Foreign Trade. Port of Santos

- Brazil in the global economy

- Balance of payments of Brazil

- Brazilian International Trade

- Expansion and Diversification of the Brazilian Foreign Trade

- Regional Economic Organizations related to Brazil

- Brazilian international trade relations as a member of the MERCOSUR

- Foreign Trade Africa-BRICS (Brazil)

- Investment in Brazil

- Case Study: Investment opportunities in the Port sector

The Subject “International Trade of Brazil” belongs to the following Online Programs taught by EENI Global Business School:

Masters: International Business, Foreign Trade.

Doctorate: American Business, World Trade.

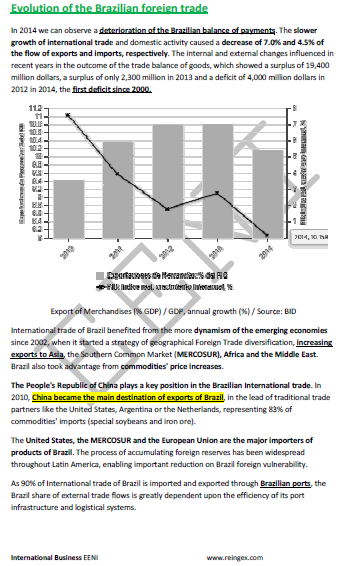

Sample - Evolution of the Brazilian foreign trade

The Foreign Trade of Brazil (South America) benefited from more dynamism of the emerging economies since 2002, when it started a geographical foreign trade diversification strategy, increasing the exports to Asia, the MERCOSUR, Africa, and the Middle East.

- Brazil (BRICS Countries) also took advantage from the increase of the commodities prices

- China plays a key position in the Brazilian International Trade. China became the main export destination of Brazil, in the lead of traditional trade partners like the U.S., Argentina or the Netherlands, representing 83% of commodities imports (special soybeans and iron ore)

- The U.S., MERCOSUR, and the EU are the largest importers of the Brazilian products

- Since 2007, Brazil has received a substantial foreign direct investment inflow owing to the investment grade rating

- Foreign Direct Investment and stock market investments augmented up to 70% of the Brazilian foreign liabilities

- Brazil jumped last year to the fifth place among the largest foreign direct investment destination

- Investment in Brazil grew from USD 26 billion in 2009 to USD 48 billion

- Only the U.S. (USD 228 billion), China (USD 106 billion), Hong Kong (USD 69 billion) and Belgium (USD 62 billion) received more foreign direct investment (FDI) than Brazil

- The majority of the FDI is concentrated in the South and South-east Brazilian states (Rio de Janeiro, Rio Grande do Sul, and São Paulo)

- 90% of the international trade of Brazil is imported and exported through the Brazilian ports

- The Port of Santos handles substantial volumes of all modalities of international cargo and leads the ranking for general and containerized cargoes that usually entail higher value-added products

Sample:

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page

or

or