Letters of Credit

International Payment Methods. Letters of Credit. Documentary credits UCP 600

- Introduction to the International Payment Methods

- Countries and payment terms

- Bills of Exchange

- Bank Draft

- Bank Transfer

- Bank payment obligation (BPO)

- Open Account

- Clean collection

- Documentary Collections

- Letters of Credit (L/C)

- Types and modalities

- Terminology

- Opening a letter of credit

- Availability

- Contents of the letter of credit

- Documents

- UCP 600

- Electronic L/C (e-UCP)

- Analysis of the Documentary Credits

- Import letters of credit

The Subject “Methods of payment/Letters of Credit” aims at:

- Analysing the various methods of payment used in international trade and outlining their differences, advantages, and disadvantages both for the importer and the exporter

- Understanding what documentary collections are and how they work. The export and import collections will be analyzed

- Understanding the following:

- Importance of the Documentary Credits and the letters of credit in international trade

- How the Documentary Credit works

- Obligations of the involved parties

- How import documentary credits operate

In this subject:

- We will examine how to receive and effect the payment for an international sales contract

- The student will become familiar with the parties, obligations, and the key terminology used in the documentary credit operations

- As well as, the student learns about the key checklists to take into account when preparing the documents for presentation under a documentary credit

The focus will be on the export methods of payment. The information presented here is also applicable to the import transactions.

The selection of the most suitable method of payment is a key factor of a successful export sale.

Legislative texts related to International payments, United Nations Commission on International Trade Law (UNCITRAL).

- United Nations Convention on Independent Guarantees and Stand-by Letters of Credit

- UNCITRAL Model Law on International Credit Transfers

- United Nations Convention on International Bills of Exchange and International Promissory Notes

- United Nations Convention on the Transfer of Credits in International Trade

Documentary Collection

- Documentary collection

- Clean Collection

- Bill of Exchange

- Managing collections

- Documentary Collection Simulation

Objectives:

- To learn the differences between clean and documentary collections and analyze the advantages and disadvantages for the importer and the exporter

- To find out how to complete a Bank Documentary Collection order and how to manage the export collections at the Bank

- To understand the difference between documents against acceptance and documents against payment

Example of the Subject - Methods of payment/Letters of Credit:

The Subject “Methods of payment / Letters of Credit” belongs to the following Online Programs taught by EENI Global Business School:

Courses: Foreign Trade Assistant, Payment Methods.

Masters: International Business, Foreign Trade.

Languages:  or

or  Crédits Documentaires

Crédits Documentaires  Créditos documentarios

Créditos documentarios  Crédito Documentário

Crédito Documentário

Credits of the Subject “Methods of payment/Letters of Credit”: 4 ECTS.

Methods of payment/Letters of Credit).

A documentary credit is an agreement under which a Bank is acting at the request and instructions of the importer, the Bank makes an undertaking to effect payment to the exporter against the presentation of the required documents within the specified period, provided that the documents strictly comply with the terms and conditions stipulated in the documentary credit.

The Letters of Credit are more favorable for the exporters rather than to the importers, as they are aimed at protecting the exporter.

This is a short but crucial subject. The ability of the trade practitioner and their bankers to issue documentary credits, which are complete and precise, is essential.

This subject will familiarise the student with the role of the Issuing Bank, how to complete the documentary credit application form and the most importantly, how to analyze the credit as issued.

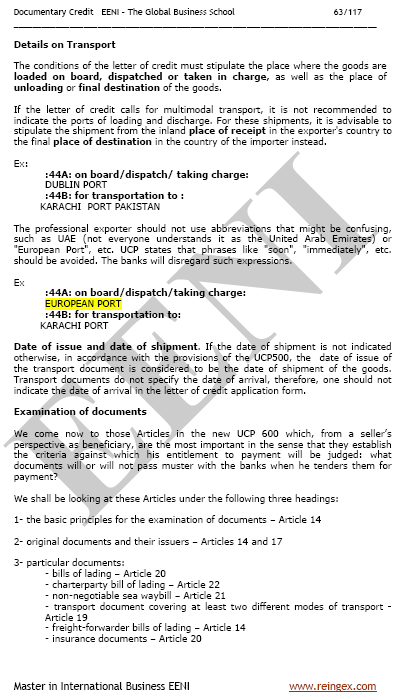

FIATA Transport Documents and Documentary Credits:

- FIATA FBL: UCP 600, negotiable document, unless it is specified as “non-negotiable”

- FIATA FWB: UCP 600, non-negotiable

- eFBL Bill of Lading: legal equivalent to paper (FBL Bill of Lading)

- FIATA FCR: allowed in a Letter of Credit, it is not accepted as a transport document, FCR is a non-negotiable document

- FIATA FCT: FIATA FCT is admitted in a documentary credit, FCT is negotiable when it is specified that it is “to order of”

- FIATA FWR: FWR is a non-negotiable document, unless it is expressly specified as negotiable (to order)

Documentary Collection

It is a method of payment whereby the exporter initiates, through the banking system, the collection of money due to him from the importer.

- Payment will be made against a Bill of Exchange and title documents

- Documents can be released against the acceptance of the Bill of Exchange or payment at sight

This subject will give the student a practical understanding of the Documentary Collections

The Uniform Rules for Collections (International Chamber of Commerce Publication), shall apply to all collections where such rules are incorporated into the text of the “collection instruction.”

In this subject we will provide a practical examples of the application of URC 522. All serious International Trade specialists should obtain a copy of this International Chamber of Commerce Publication.