Brazilian Customs, Foreign Trade, Exports

Import Procedures in Brazil. Brazilian Customs, tariffs

The Federative Republic of Brazil, as a member of MERCOSUR, applies MERCOSUR Common External Tariff.

- Brazil as a member of MERCOSUR

- MERCOSUR Trade Agreements

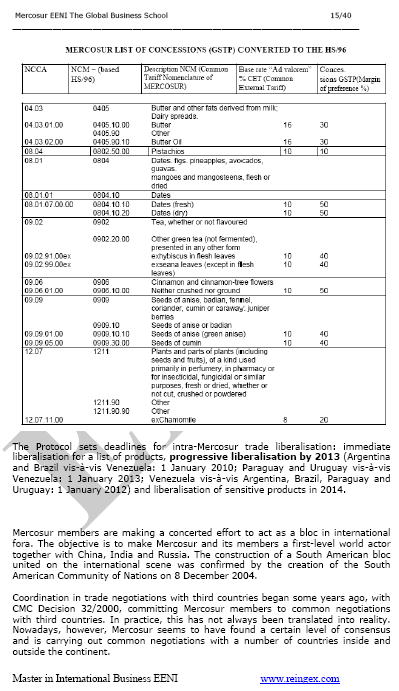

- Common External Tariff of MERCOSUR

- Import Regime in Brazil

- Brazilian import tariffs

- Import Procedures in Brazil

- Import Licensing

- Sanitary and Phytosanitary Measures

- Labeling in Brazil

- Special administrative requirements for agricultural products

The Subject “Brazilian Customs” is included within the curriculum of the following academic programs at EENI Global Business School:

Masters: International Business, Foreign Trade.

Brazilian Customs - Import procedures.

Import products in Brazil are taxed by Tariffs and other import taxes such as IPI, ICMS, PIS and CONFIS:

- Tax on Industrialized Products (IPI)

- Tax on Circulation of goods and services (ICMS)

- Contributions to PIS (Social Integration Programme) and CONFIS (Social Contribution to Social Security Financing)

- Tax on service delivery

The General MFN (Most-favoured-nation) not subject to Foreign Trade preference varies between 0% and 35%.

- All tariffs in Brazil are ad valorem and applied on the CIF value of the imported product

- The Brazilian import tariffs are comparatively progressive (higher for higher value-added products and reduced prices for raw materials)

- Brazil applies an import licences administrative system (statistical and control purposes)

- All the goods to be imported into Brazil must be subject to import clearance

- Brazil does not apply non-preferential Rules of Origin

- World Trade Organization (WTO)

- Agreement on Trade in Services (GATS)

- Agreement on Sanitary Measures

- Agreement on Technical Barriers to Trade

- Agreement on Preshipment Inspection

- Agreement on Safeguards

- Trade Facilitation Agreement

- World Customs Organization (WCO)

- BIC (Containers)

- Chicago Convention (ICAO)

- International Maritime Organization (IMO)

- Hamburg Rules (Maritime Transport)

- International Road Transport Union (IRU)

- International Chamber of Shipping

- Customs Convention on Containers - not a member

(c) EENI Global Business School (1995-2025)

Top of this page

WhatsApp

WhatsApp

+

+