European Customs Union (EU) TARIC

Pillars of the European Customs Union. Common rules of origin

- Introduction to the Customs Union of the European Union

- Need for the EU Customs Union

- The Pillars of the European Customs Union

- Common Customs Tariff

- Common rules of origin

- Customs transit

- Common customs valuation system

- The European Union Product classification system

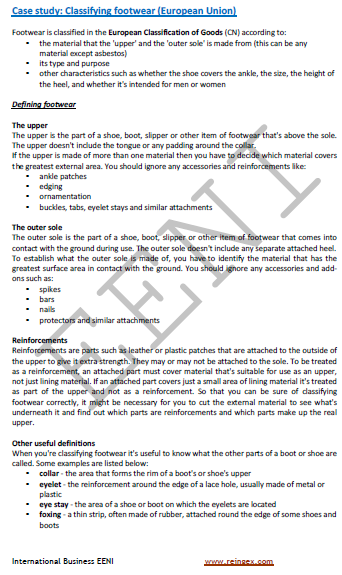

- Case study. How to classify computers and software, fruits, vegetables, footwear, plastics and textiles

- Integrated Tariff of EU (TARIC)

- Value Added Tax in the European Union

- Special taxes

- Fraud Prevention

- Customs co-operation agreements and mutual administrative assistance

- New EU Customs Code (formerly: Community Customs Code)

Sample - European Customs Union (EU):

NOTE: points 5 and 6 are also discussed in the subject: How to export to the European Union.

The educational aims of the Subject “European Customs Union (EU)” are:

- To understand the pillars of the European Customs Union (EU)

- To analyze the functioning of the European Customs Union

- To learn about New Union Customs Code

The Subject “European Customs Union (EU)” is included within the curriculum of the following academic programs at EENI Global Business School:

Masters: International Business, Foreign Trade.

Languages:  or

or  Unión Aduanera UE

Unión Aduanera UE  Union douanière UE

Union douanière UE  União Aduaneira UE.

União Aduaneira UE.

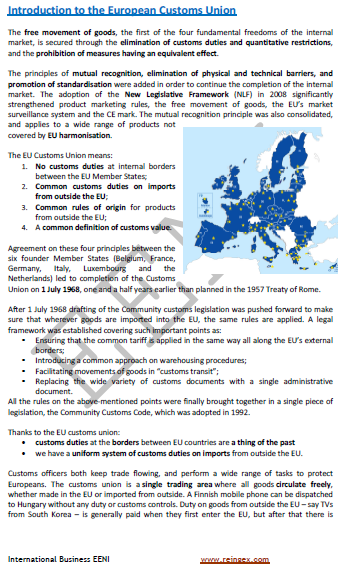

The four pillars of the European Customs Union are:

- The absence of customs duties between the EU member countries

- The adoption of common tariff to imports from the non-EU countries

- The introduction of common Rules of Origin for all the goods imported from a third country

- The use of a single customs valuation system

The European Union Customs Union has been in force since 1 July 1968 (Belgium, France, Germany, Italy, Luxembourg and the Netherlands).

The remaining countries have been progressively incorporated: Austria, Bulgaria, Croatia, Cyprus, Denmark, Estonia, Finland, Greece, Hungary, Ireland, Latvia, Lithuania, Malta, Poland, Portugal, Slovakia, Slovenia, Spain (Ceuta and Melilla are not part), the Czech Republic, Romania and Sweden (Europe).

- The Third-country customs revenue accounted for 11% of EU budget (EUR 15.3 billion)

- The European Union customs manage approximately 16% of world trade

- The European Union customs seized 36 million of products (25% of which were counterfeit medicines)

- Andorra, San Marino and Turkey have a Customs Union with the European Union

- All Countries of EU are part of EU Customs Union

The European Union has customs cooperation agreements and mutual administrative assistance with the United States, Canada, India, Japan, Hong Kong, South Korea and China. These customs cooperation agreements simplify and harmonize the customs procedures, reducing the export-import costs.

European Economic Area (Western Civilization).

(c) EENI Global Business School (1995-2025)

Top of this page

WhatsApp

WhatsApp