Investments abroad (FDI)

Investments abroad: sales, delegations, and joint ventures

The international expansion process can finalizes with the creation of one or various sales delegations wherefrom, by area, the commissioned representatives are controlled.

Various legal ways exist for their establishment, all of which are destined to assure a steady presence with a rigorous tax control and parent company protection.

We will analyze the three most frequent cases for establishment from a commercial perspective:

- Foreign company branch

- Subsidiary

- Joint Ventures

Investments abroad:

The Subject “Investments abroad” belongs to the following Online Programs taught by EENI Global Business School:

Diploma: International Marketing.

Course: Internationalization and Investments.

Masters: International Business, Foreign Trade and Global Marketing.

Doctorate: Global Logistics, World Trade.

Languages:  or

or  Inversión extranjera directa

Inversión extranjera directa  Investissement direct à l’étranger.

Investissement direct à l’étranger.

Area of Knowledge: Internationalization.

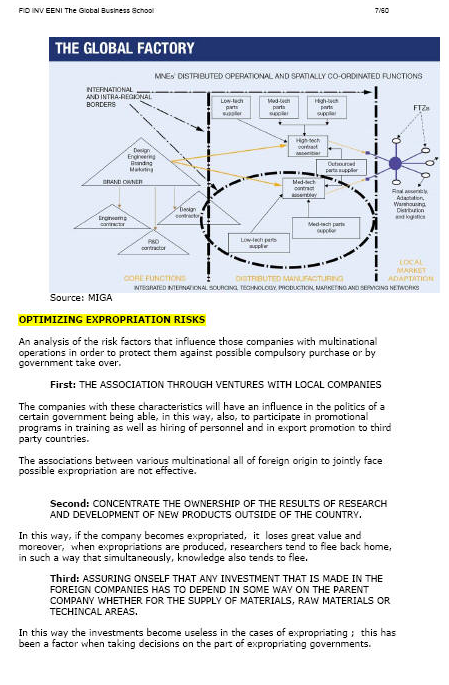

An analysis of the risk factors that influence those companies with multinational operations to protect them against the possible compulsory purchase or by a Government takes over.

Case study: Establishing a company in the U.S.. One company is made up of 150 full-time workers and manufacture bronze statues that are on a marble support. The designs are exclusive and using them; they make a substantial production of each one; even though it is a gift item with certain exclusive value; they are pieces whose originals were produced in large quantities. In this case; we will analyze eleven decisions taken by the Board of Directors.

We tend to associate the developing countries with poverty and suffering. This image is reinforced by the media because they inform us only about disasters in these countries and present their people as victims of circumstances beyond their control. The reality of the developing world is a lot more varied and complex. In the first place, one has to be careful with generalizations.

For example, the situation in recently industrialized countries like Korea, Malaysia, China, Mexico, and Brazil is very different to the Less Developed Countries like Bangladesh, Senegal, Ghana, Kenya, Morocco, Nicaragua, El Salvador, or Peru. Besides, the situation in the developing World is not static.

In the last decades, countries in South-east Asia have gone through significant progress in their standard of living, while countries from the Sub-Saharan Africa are poorer nowadays than they were in the middle of the 1960s.

The socio-cultural context of each developing country has prime importance in the sale of a product. Religion, local traditions, history, superstitions, all these form part of a system of values that are called culture.

The obtaining permits or licences and establishing a business process in a developing country can be as long as it is costly. Much of the Government earnings come from such licences. The trouble of corruption can also present itself.

Increasingly, the social balance of a company, demands new management parameters of CORPORATE GOVERNANCE that can convert the companies into real engines of development and well-being in the place they are operating.

The situation in the former Soviet Republics. Analysing the actual situation in the Russian Federation implies analysing a series of points synthetically, so much so that probably the different points could be seen as headings.

Analysis of the industry reconstruction process in the former Soviet Republics.

Multinational Organizations like the EU, the Inter-American Development Bank, the African Development Bank, and the IMF, amongst others, direct significant quantities of economic resources towards social and Economic restructuring in the developing countries, so that in this way they can speed up growth. Therefore, one is transferring “know-how” towards countries in need for this knowledge.

The considerations that should be taken into account before productive Foreign direct investment (FDI) surpass commercial decisions.