Investment in India

Foreign direct investment in India (Bharat)

- Investment in India (Hindu Economic Area)

- Investment policy

- Investment opportunities and incentives in India (Bharat)

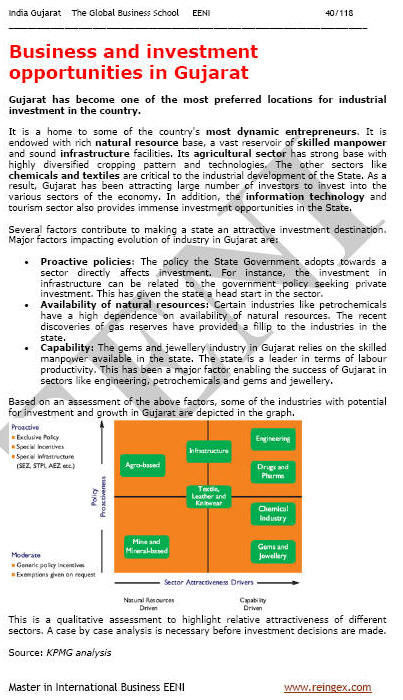

- Top India Sectors Attracting FDI

- Electrical

- Services

- Telecommunications

- Transport

- Information Technology

- Entry options for the foreign investors

- Taxes in India (Bharat)

Foreign direct investment in India

The Subject “Foreign direct investment in India (Bharat)” belongs to the following Online Programs taught by EENI Global Business School:

Masters: International Business, Foreign Trade.

Course: Hinduism and Business.

Languages:  or

or  India

India  Inde

Inde  India.

India.

- Credits of the subject “Foreign direct investment in India”: 1

- Duration: one week

Masters adapted to  Indian Students (Bharat).

Indian Students (Bharat).

The sole and huge geography of India gifted with a different topography, has made India one of the most attractive foreign direct investment destinations in the World.

Foreign direct investment in India.

India has become a global source for the various manufacturing and services industry.

- With the largest area of arable land, India is one of the largest food producers in the World

- India is the largest milk, sugar-cane, and tea manufacturer as well as the second largest rice, fruit, and vegetables manufacturer

- The pool of technical human resources of India with an increasing disposable revenue and its burgeoning market have all combined to enable India to emerge as a viable partner to the global industry

- India is the preferred hotspot for Organizations keen to outsource their activities, software development work, customer contact centers or Information Technology enabled business process

- Top sectors attracting the highest Foreign direct investment inflows into India are electrical equipment, services sector (financial and non-financial), telecommunications, transport industry (Asia-Africa Growth Corridor), fuels, chemicals, construction activities, drugs and pharmaceuticals, food processing, cement, and gypsum product

- Huge investment potential exists in the upcoming Knowledge Process Outsourcing sector and real estate industry

- Thus, India is one of the few markets in the World, which offers high forecasts for economic growth and earning potential in practically all fields of business, especially in tourism, information technology, and agricultural sector

- New Delhi, Mumbai, Bangalore, Gujarat, Andhra Pradesh, and Chennai are the main destination for the foreign direct investment inflow

- Maharashtra and the National Capital Region accounted for more 50% of the foreign direct investment inflows into India

- FDI is welcome in nearly all the areas, excluding those of strategic concern (for instance, defense and atomic energy)

- The Indian Government has recently passed a Special Economic Zones Bill

- All Intellectual Property Rights (IPR) laws are TRIPS (Trade-Related Aspects of Intellectual Property Rights) compliant with a completely functional Intellectual Property Appellate Tribunal

To promote the investment flows into India, the Government of India has set up several investment Facilitation agencies, which include:

- Foreign Direct Investment Promotion Board

- Foreign Direct Investment Implementation Authority

- Investment Commission

- Secretariat for Industrial Assistance

- Indian Brand Equity Foundation

Sectors, where Foreign direct investment (FDI) is not allowed, are limited to the Rail transport, Atomic Energy and Atomic Minerals, Postal Service, Gambling and Betting, Lottery, and basic agriculture or plantations.

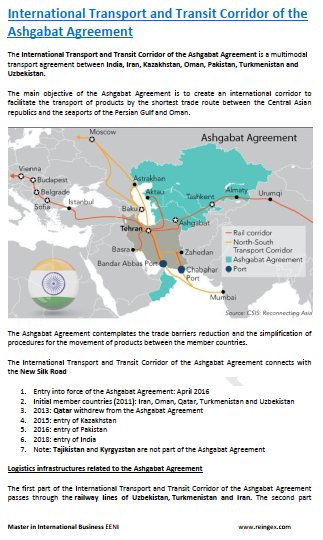

Logistics Corridors:

- Asia-Africa Corridor

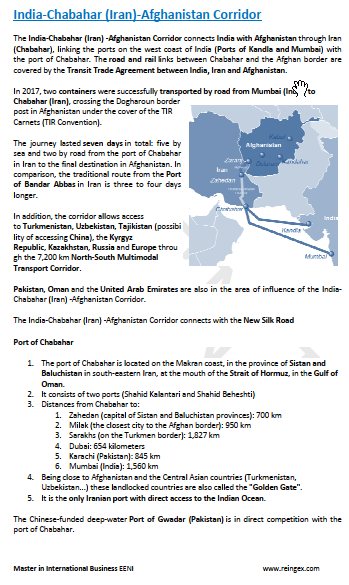

- India-Afghanistan Corridor

- Corridor of the Ashgabat Agreement

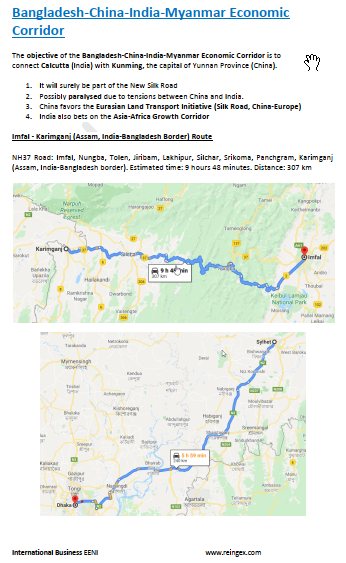

- Bangladesh-Myanmar Corridor

- North-South Corridor (India-Russia)