Greater Arab Free-Trade Area (GAFTA)

GAFTA: Saudi Arabia, Bahrain, Emirates (Greater Arab Free-Trade Area)

- Introduction to the Greater Arab Free Trade Zone (GAFTA), or Pan-Arab Free Trade Zone

- The role of the Arab League in the Pan-Arab Free Trade Area

- Main advantages for member countries

- Arab Customs Union

- Arab Common Market

The Subject «Greater Arab Free-Trade Area (GAFTA)» belongs to the following Online Programs taught by EENI Global Business School:

Masters: International Business, Foreign Trade, Religions & Business.

Doctorate: Islamic Business, World Trade, Ethics, Religion & Business.

Courses: Islam & Business, Business in the Maghreb.

Languages:  or

or  Gran Zona Árabe de Libre Comercio (GAFTA)

Gran Zona Árabe de Libre Comercio (GAFTA)  Grande zone arabe de libre-échange (GZALE)

Grande zone arabe de libre-échange (GZALE)  Grande Área Árabe de Livre-Comércio (GAFTA).

Grande Área Árabe de Livre-Comércio (GAFTA).

Sample:

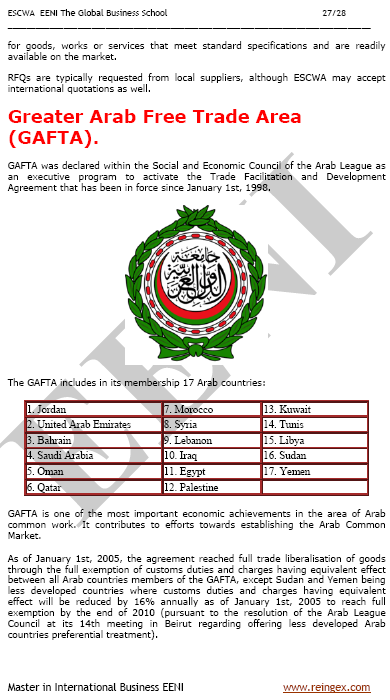

The Greater Arab Free Trade Zone (GAFTA), or Pan-Arab Free Trade Zone, was created by the Economic and Social Council of the Arab League with the aim of improving trade facilitation, promoting intra-regional trade, economic unity and liberalization, and removing technical barriers to trade between 17 Arab countries:

- Middle East: Bahrain, Iraq, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Somalia, Syria, Emirates, and Yemen

- Africa: Algeria, Egypt, Libya, Morocco, Sudan, Tunisia

- The Arab League countries that are not members of the Greater Arab Free Trade Area (GAFTA): Comoros, Djibouti, Mauritania, and Somalia

All the member countries of the Greater Arab Free Trade Area (GAFTA) are members of the Economic Commission for Western Asia (ESCWA) and the Organization of Islamic Cooperation.

- Arabic name: منطقة التجارة الحرة العربية الكبرى

- Entry into force: 1/1/1998

The GAFTA Free Trade Agreement applies to industrial, agricultural and animal products (exempt from customs duties).

Products that are prohibited (to be marketed) by religious, environmental, safety and health products prohibited for trade are excluded.

Intra-regional trade between Arab countries is dominated by Saudi exports (petroleum-related products).

The Arab Customs Union was announced by the Arab League in 2009 in order to achieve a customs union in 2015 and an Arab Common Market in 2020 in order to increase trade and integration between the member countries of the Greater Arab Free Zone. Commerce (GAFTA).

The Greater Arab Free Trade Zone (GAFTA) belongs to the Arab Economic Area and the Maghreb Economic Area of Islamic Civilization.

The Greater Arab Free-Trade Area (GAFTA) belongs to the Arab Economic Area and the Maghrebian Economic Area of the the Islamic Civilization.

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page