International Trade (Online Bachelor of Science)

Techniques of International Trade: Incoterms® 2020, Customs, Documentary Credits (Bachelor of Science in Inter-African Business, e-learning, second semester)

| Bachelor of Science in Inter-African Business |

Subject - “Techniques of International Trade (Incoterms® 2020, Customs, documentary credits)” (6 ECTS) - Online Bachelor of Science in Inter-African Business (second semester).

Syllabus of the Program: Incoterms® 2020

- Introduction to the Incoterms

- What are the Incoterms® 2020?

- Key changes to the Incoterms® 2020

- The Review of the Incoterms® FCA (Free Carrier)

- The change from DAT (Delivered at Terminal) to DPU (Delivered at Place Unloaded)

- Different levels of insurance coverage under CIF and CIP

- Associated costs for each Incoterm (article A9 / B9)

- Analysis of the Incoterms® 2020

- Incoterms® 2020 and international transport

- Incoterms® 2020 for sea and inland waterway transport: FAS (Free Alongside Ship) - FOB (Free On Board) - CFR (Cost and Freight) - CIF (Cost, Insurance & Freight)

- Incoterms® 2020 for any mode of transport: EXW (Ex Works) - FCA (Free Carrier) - CPT (Carriage Paid To) - CIP (Carriage and Insurance Paid to) - DAP (Delivered At Place) - DPU (Delivered at Place Unloaded) - DDP (Delivered Duty Paid)

- How are they used?

- Criteria for selection of the Incoterms® 2020

Objectives of the Program “Incoterms® 2020”:

- To understand the importance of the Incoterms® 2020 in Foreign Trade

- To learn how to calculate the price in function of the Incoterms® 2020

- To know the risk, cost and formalities required in function of the selected Incoterm

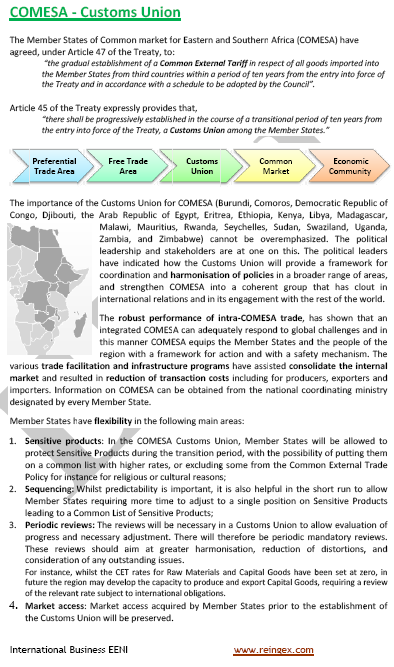

Syllabus of the Program: Customs Procedures.

- Introduction to the Customs procedures

- Functions of Customs

- Examination of goods

- Classification of goods

- Customs treatment and clearance

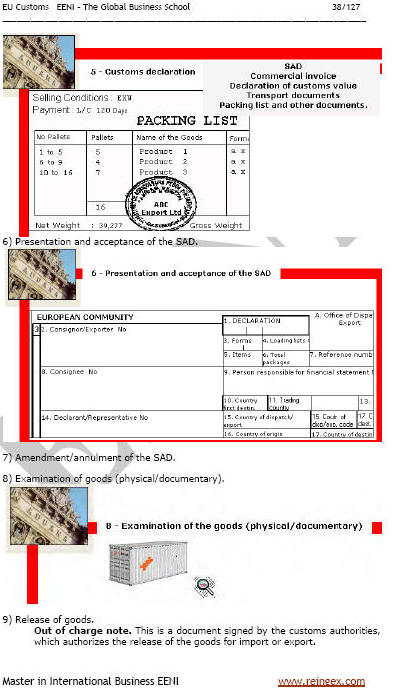

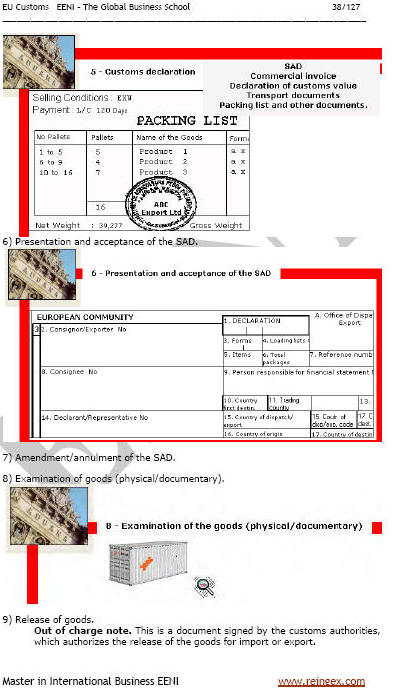

- Summary declaration

- Release for free circulation

- Dispatch for consumption

- Origin of goods

- Customs Legislation. Customs valuation in the EU

- Import Procedures

- Single Administrative Document

- VAT payable on imported goods

- TARIC (Integrated Tariff of the Community)

- Customs agents

- Case Study:

- European Customs Union (EU)

- China Customs

- EU-Turkey Customs Union

- Market Access database (EU)

Objectives of the Program “Customs and International Trade”:

- To understand the role and functioning of Customs in foreign trade transactions, as well as the different trade regimes and methods of classification of products

- To know the import process of a product as well as customs procedures

- To know the Regional Integration Process and his relationship with customs: EU, MERCOSUR, Andean Community, Central American Integration System, ASEAN, Gulf Cooperation Council (GCC), Arab Maghreb Union (AMU), ECOWAS, WAEMU, ECCAS, CEMAC, SADC, EAC, e IGAD..

Syllabus of the Program: World Customs Organization (WCO).

- Introduction to the World Customs Organization (WCO)

- Agreement on Rules of Origin of the WTO

- Harmonized System (HS) of the WCO

- Customs Procedures and Facilitation

- Rules of Origin

- Customs Valuation

- Customs Enforcement and Compliance

- SAFE Package

- Conventions:

- Revised Kyoto Convention

- ATA System (Convention Relating to Temporary Admission)

- Customs Convention on Containers

- Case Study: market access map

The objectives of the Program “World Customs Organization”:

- To know the objectives of the WCO (OMA)

- To understand the Harmonized System

- To understand the Customs Valuation methods and criteria of origin

- To analyze trade facilitation programs and customs procedures

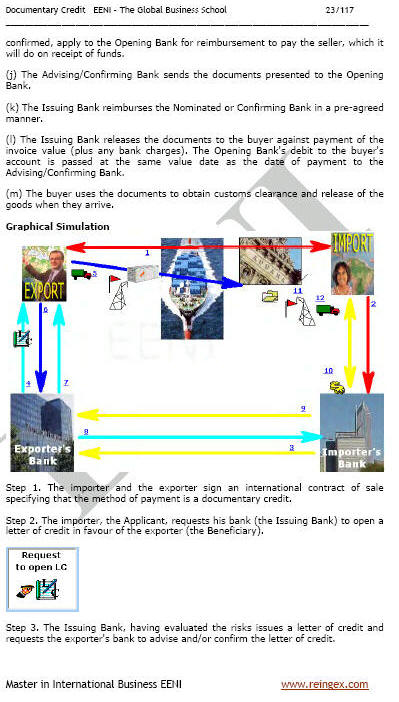

Syllabus of the Program: Documentary credit. Methods of Payment.

- Introduction to the International Payment Methods

- Bank Transfer

- Bank Draft

- Bills of Exchange

- Clean collection

- Documentary Collections

- Letters of Credit (L/C): types, modalities, terminology, and availability

- Opening a letter of credit

- Contents of the letter of credit

- Documents required

- UCP 600

- Electronic L/C (e-UCP)

- Analysis of the Documentary Credits

- Import letters of credit Case Study: M-PESA in East Africa

Objectives of the Program “Documentary credits”:

- To understand the different Methods of Payment used in International Trade and outlining their differences, advantages, and disadvantages both for the importer and the exporter

- To understand what documentary collections are and how they work

- To understand the importance of the documentary credit in Foreign Trade transactions and its functioning

- To know the importance of the Documentary Credits and letter of credit in international trade

Samples: Techniques of International Trade (Incoterms® 2020, Customs, documentary credits) (Bachelor of Science in Inter-African Business, e-learning, second semester).

Language of the subject “Techniques of International Trade (Incoterms® 2020, Customs, documentary credits)” of the Bachelor of Science in Inter-African Business taught by EENI Global Business School (second semester):

or

or  EENI

EENI  EENI

EENI  EENI.

EENI.

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page