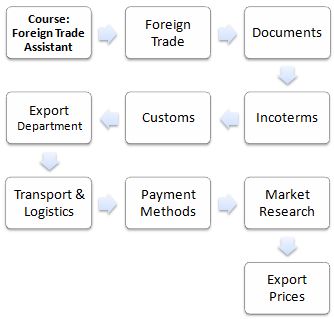

Subjects (Course: Foreign Trade Assistant)

Detailed content of the Subjects of the Course “Foreign Trade Assistant”

Online Course “Foreign Trade Assistant” taught by EENI Global Business School.

Download the syllabus (PDF) of the Professional Course.

ECTS = European Credit Transfer and Accumulation System

Enrol / Request for Information

Enrol / Request for Information

Subjects of the Course “Foreign Trade Assistant”

Introduction to Foreign Trade (1 ECTS)

- Introduction to Foreign Trade

- Advantages of exporting

- Resources Needed for exporting

- Starting the Export Activity

- Export Process

- Problems deriving from Non-Internationalization

The objectives of the subject “Introduction to Foreign Trade” are the following:

- To understand the nature of exporting and the difficulties that may arise

- To learn about import and export transactions, the difficulties with them and how to overcome these challenges

- To analyze the advantages of exporting and the risks of not exporting

This will be achieved by:

- Examining the fundamental questions related to the export process

- Analysing the challenges to overcome in an export transaction

- Detailing the steps necessary to beginning the export process

Foreign Trade Documents (1 ECTS).

- The role of the documents in the Foreign Trade Back Office and International Trade

- International transport documents

- Commercial documents (proforma, invoice, packing list...)

- Origin documents

- Other Foreign Trade Documents

The objectives of the subject “International Trade Documents” are the following:

- To know the function of the main documents used in imports and exports

- To know how to fill them out properly

- To know how to perform the check-list of the Foreign Trade Documents

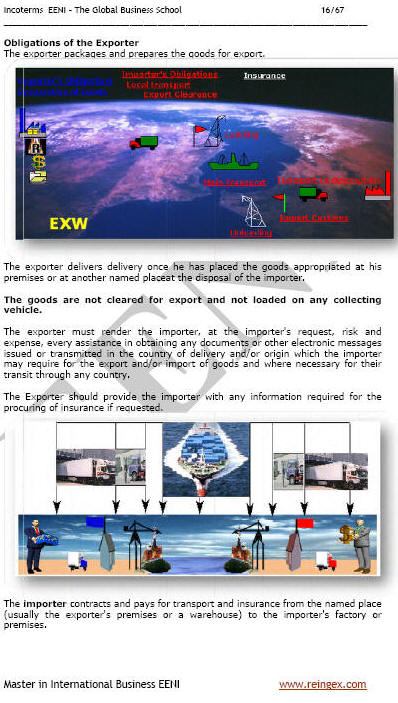

Incoterms® 2020 (2 ECTS)

- Introduction to the Incoterms

- What are the Incoterms® 2020?

- Key changes to the Incoterms® 2020

- The Review of the Incoterms® FCA (Free Carrier)

- The change from DAT (Delivered at Terminal) to DPU (Delivered at Place Unloaded)

- Different levels of insurance coverage under CIF and CIP

- Associated costs for each Incoterm (article A9 / B9)

- Analysis of the Incoterms® 2020

- Incoterms® 2020 and international transport

- Incoterms® 2020 for sea and inland waterway transport: FAS (Free Alongside Ship) - FOB (Free On Board) - CFR (Cost and Freight) - CIF (Cost, Insurance & Freight)

- Incoterms® 2020 for any mode of transport: EXW (Ex Works) - FCA (Free Carrier) - CPT (Carriage Paid To) - CIP (Carriage and Insurance Paid to) - DAP (Delivered At Place) - DPU (Delivered at Place Unloaded) - DDP (Delivered Duty Paid)

- How are they used?

- Criteria for selection of the Incoterms® 2020

The objectives of the subject “Incoterms® 2020” are the following:

- To understand the importance of the Incoterms® 2020 in Foreign Trade

- To know which Incoterms® 2020 are the most suitable for the different types of International Transport

- To know how to calculate the export prices based on the Incoterms® 2020

- The risk, cost and necessary procedures according to the selected Incoterm

Customs. World Trade Organization (WTO) (4 ECTS).

- Customs in Foreign Trade

- Customs classification

- Customs regime

- The role of the customs agent

- Customs clearance

- Inspection of the products at customs

- Origin of products

- Market Access database (EU)

- Trade Facilitation Agreement

- World Customs Organization (WCO)

- Kyoto Convention

- Convention Harmonization of Frontier Controls of Goods

- Global System of Trade Preferences (GSTP)

- Harmonized System (HS)

- Rules of Origin

- Agreement on Rules of Origin of the WTO

- Trade facilitation

- Customs Procedures

- SAFE Package

- Kyoto Convention

- The World Trade Organization and Customs

- Rules for the customs valuation of products

- Customs Valuation Methods:

- Transaction value

- Identical or similar goods

- Deductive or computed method

- Fall-back

- Rules of Origin

- Import licenses

- The WTO Agreements on Technical Barriers to Trade (TBT), Sanitary and Phytosanitary Measures (MSF), and Pre-shipment Inspection

The objectives of the subject “Customs” are the following:

- To understand the customs procedures in foreign trade, the different commercial regimes and the methods of product classification

- To learn about the fundamental concepts related to the customs: customs clearance, customs valuation, non-tariff barriers and obstacles, pre-shipment inspection, origin of goods, Harmonized System, customs processes..

- To know the process of importing a product and the customs regimes

- To understand the functions of the WCO and the WTO related to the customs

Export Department (1 ECTS).

- Introduction to the Export Department

- Set up and run of the export department

- Functions, goals, and organization of the export department

- Resources needed

- Director of International Business, export manager, and country area manager

- Foreign Trade Back Office

- Foreign Trade Assistant

- Secretary of the department of International Trade

- Case Study:

- Analysis of the differences between the Export Departments in Spain and Latin America (Iberian America)

- Sales areas assignment in the international department

The objectives of the subject “Export Department” are the following:

- In this subject, the student will learn how to set up and run an export department

- We will also discuss the functions and goals of the export department

This will be achieved by:

- Examining the characteristics of an export manager

- Outlining the most important functions of an export department

- Analysing the goals of an export department and how to benchmark them

- Detailing how to best support the export department work

International Transport and Logistics (5 ECTS)

- Introduction to the International Transport and Logistics

- International transport chain

- Authorized Economic Operator

- Selecting a mode of International Transport

- Costs and insurance of International Transport

- Transport Documents related to International Trade

- Export Packaging

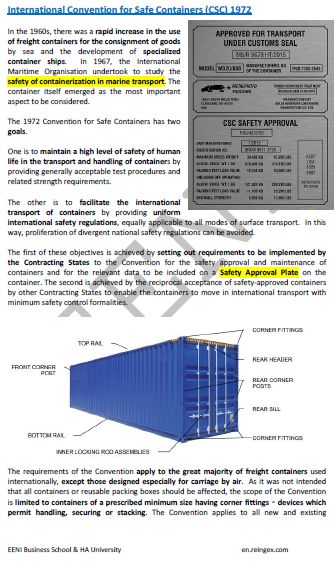

Containers and international transport.

- Customs Convention on Containers

- International Convention for Safe Containers

- Convention Relating to Temporary Admission

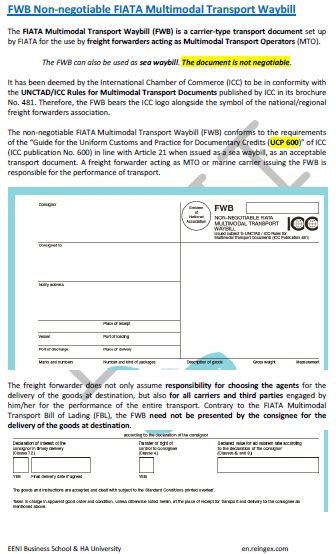

International Federation of Freight Forwarders Associations (FIATA).

- Negotiable Combined Transport Bill of Lading (FBL)

- Electronic FIATA Bill of Lading

- FIATA Multimodal Waybill FWB

- Forwarders Certificate of Receipt (FIATA FCR)

- Forwarders Certificate of Transport (FCT)

- Warehouse Receipt

The objectives of the subject “Introduction to International Transport and Logistics” are:

- To have a global vision of logistics and international transport applied to the International Trade

- To understand the functioning of the global transport chain

- To know the different techniques of export packaging and the importance of the containers

- To understand the basic concepts related to the documents, costs and insurance of International Transport

- To analyze the main documents of the FIATA

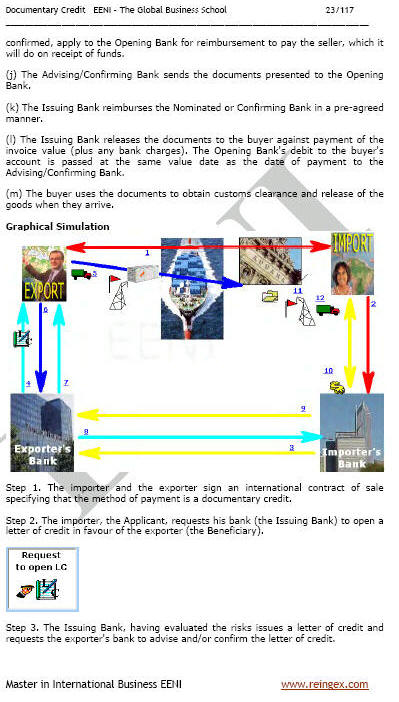

International Payment Methods. Documentary Credits (4 ECTS)

- Introduction to the International Methods of Payment and the Letters of Credit

- Documentary Collections

- The importance of the Documentary Credits in Foreign Trade

- Letter of credit

- Types, modalities and variants of the Documentary Credits

- Analysis of the contents of a letter of credit

- Analysis of the Documentary Credits

- UCP 600

- E-UCP

- United Nations Conventions related to the International Payment Methods;

- United Nations Convention on Independent Guarantees and Stand-by Letters of Credit

- United Nations Convention on International Bills of Exchange and International Promissory Notes

- United Nations Convention on the Transfer of Credits in International Trade

- UNCITRAL Model Law on International Credit Transfers

The objectives of the subject “Documentary Credits and International Payment Methods” are the following:

- To analyze the different Payment Methods used in International Trade

- To understand the fundamental role of the Documentary Credits in International Trade as well as their operation and modalities

- To know how to manage a foreign trade operation through a documentary credit

International Market Research (2 ECTS)

- Introduction to the Global Market Research

- How to export?

- What to export?

- Where to export?

- Methods of conducting a global market research

- Quantitative analysis

- Qualitative methods

- Market profitability

- Sales potential in the foreign markets

- PEST analysis (Political, Economic, Social, and Technological Factors)

- Case Study: Market research using the market access tool (MADB) of the EU

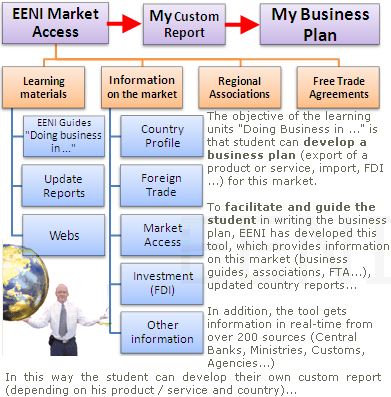

The course includes the Market Access Tool:

The main purpose of the Subject “International market research” is to understand the key tools and concepts of the international market research and how best to apply them.

- To understand the importance of the international market research in the strategies of Internationalization

- To know how to analyze an international market research

- To learn how to use the PEST analysis (Political, Economic, Social, and Technological)

This will be achieved by:

- Analysing the goals of researching a new export market

- Outlining the features of qualitative and quantitative analysis

- Detailing the type of information that the student should obtain to assess the commercial viability of an export market

Export Prices Calculation (1 ECTS)

- Introduction to the International Pricing Policy

- Product life cycle and international pricing policy

- Calculation of the export prices

- International prices and Incoterms® 2020

- Analysis of competitor's prices

- International Pricing Strategies

- Pricing strategy when entering new export markets

- Pricing options available to the exporter

- E-Business and pricing policy

- Case Study:

- Pricing Policy and Inflation

- Price of Traded Goods and Services in Asia

The main purpose of the Subject “International Pricing Policy” is to understand the importance of an appropriate pricing strategy when entering new export markets.

- We are going to examine the pricing options available to the exporter and outline the criteria to be used when establishing a pricing strategy

- We will also look at the criteria defined in pricing under the Incoterms

This will be achieved by:

- Examining the pricing options available to the exporter

- Outlining the criteria to be used when establishing a pricing strategy

- Analysing the goals of a pricing policy

- Detailing how to arrive at an export price

- Introducing the criteria defined in pricing under the Incoterms® 2020

Curso Asistente de Comercio Exterior

Curso Asistente de Comercio Exterior

Cours : assistant de commerce international

Cours : assistant de commerce international  Curso: Assistente de Comércio Exterior.

Curso: Assistente de Comércio Exterior.

(c) EENI Global Business School (1995-2024)

We do not use cookies

Top of this page